By Steven Levine

Although rosy economic conditions have generally spurred a rise in consumer spending, organizational changes and structural shifts at L Brands (LB) have helped keep the company from fully enjoying the benefits.

The Columbus, Ohio-based company, which operates brands that include Victoria’s Secret, PINK, and Bath & Body Works, recently provided disappointing third-quarter guidance and cut its outlook for the full year.

Earnings per share for Q2 2018 were US$0.36, down from US$0.48 in the same year-ago quarter, while net sales rose to roughly US$2.98bn from US$2.76bn over the same period. LB’s comparable sales for the 13 weeks ended August 4, 2018, increased 3% compared to the same year-ago period – driven mainly by performance at Bath & Body Works.

However, although the company beat analysts’ earnings expectations, it downwardly revised its guidance for 2018 full-year EPS to US$2.45- 2.70 from US$2.70-3.00 previously and issued guidance for Q3’18 EPS between US$0.00 and US$0.05.

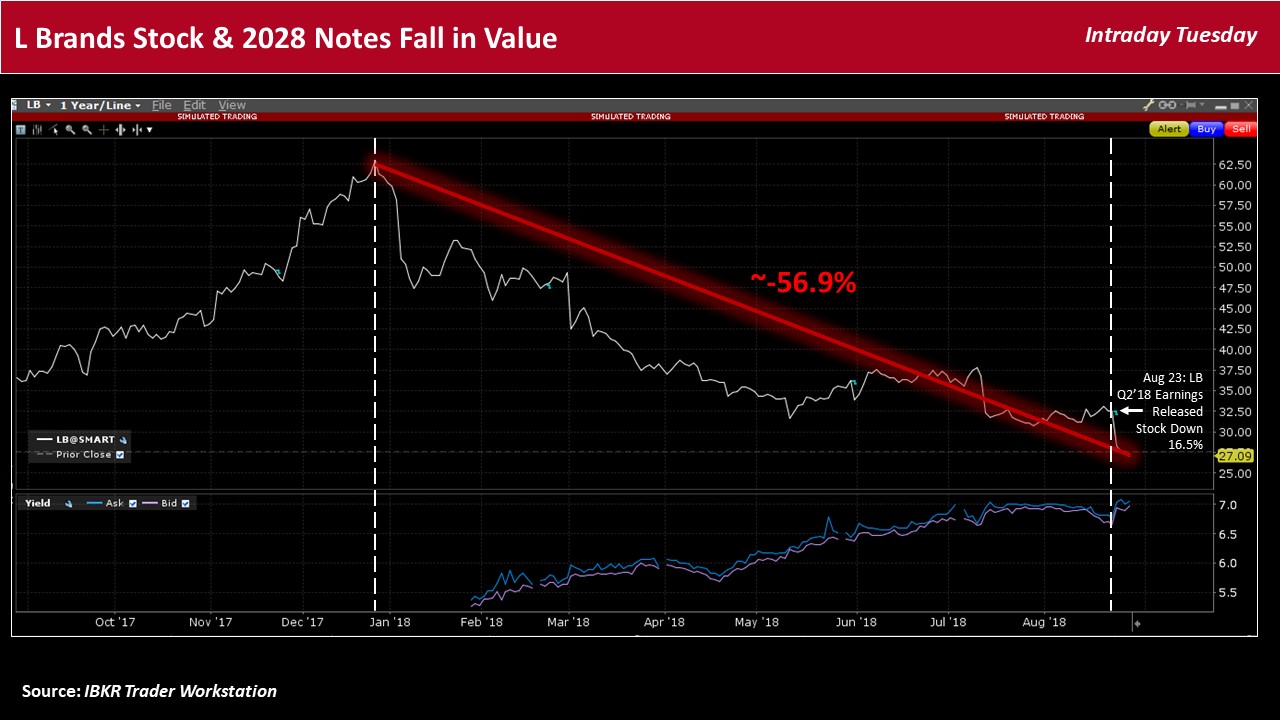

LB’s stock has fallen around 16.5% since its Q2’18 earnings release, and has shed almost 57% since its 52-week high of US$62.95 set in late December 2017.

Credit deterioration

Meanwhile, LB’s creditworthiness has also recently deteriorated along with its share value, amid structural changes and C-suite shifts.

In tandem with its earnings release, LB said that Denise Landman, CEO of Victoria’s Secret PINK, elected to retire at the end of 2018, to be replaced by Bath & Body Works’ merchandising and product development president Amy Hauk.

Gimme Credit analyst Evan Mann noted that these “factors suggest that a turnaround in Victoria’s Secret comparable sales and margin won’t be happening in the near term and its problems are more structural in nature requiring an uncertain amount of time to correct.”

Leave A Comment