About a year ago I wrote a series of posts on the relationship between the unemployment rate, labor force participation, and wage growth. Especially in view of last Friday’s jobs report, which showed blockbuster hiring, but a continuation of tepid wage growth over 8 years into the expansion, now is a good time for an update.

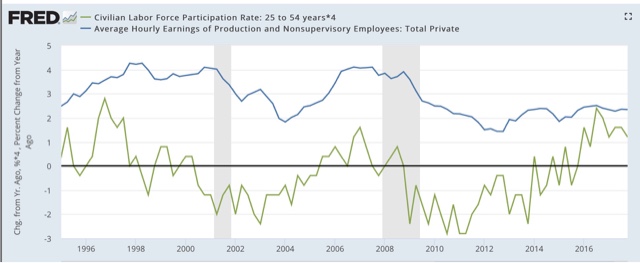

To recapitulate, history shows that wage growth is lagging the economy, and specifically only turns after the unemployment rate begins to decline. More specifically, since 1994, once the underemployment rate has fallen below about 9% (red, inverted in the graphs below), wage growth (blue) has begun to improve:

Meanwhile, the YoY% change in the prime age labor force participation rate turns about one year before wages (green):

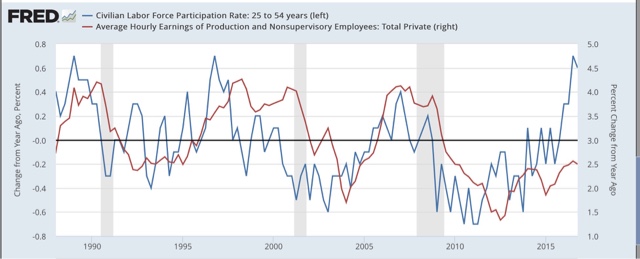

On the other hand, the absolute *level* of prime-age labor force participation only bottoms *after* wages have turned:

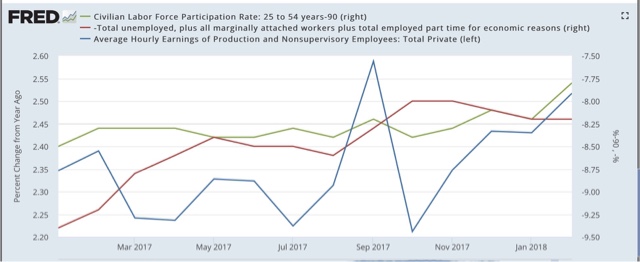

Here is the monthly graph through last Friday, showing that all three metrics have continued to improve:

In historical context, last year I suggested that the traditional Phillips curve, which posited a relationship between lower unemployment and higher wage growth and inflation, is best seen as a special variant of a broader relationship between the labor force participation rate (i.e., the total of those both employed and unemployed). On a secular basis, the correlation has been that the YoY change in labor force participation (blue in the graphs below) appears to lead improvement in wage growth (red) by about one year. Here’s the high-inflation, high labor bargaining power 1960s, and 1970s:

and there is a low inflation, low bargaining power era since 1988:

In both of these eras, generally, participation led wage growth by about one year.

Last year I also suggested that a more nuanced cyclical feedback mechanism appeared to be that too rapid an increase in participation will lead either to higher inflation (the 1960s and 1970s) or lower short-term wage growth (the 1980s to present. I showed that via a variation on the misery index that double-weighted inflation, in which the only major departures were the Oil shocks of 1974, 1979, 1990, and 2008:

Leave A Comment