Where is the Growth Potential in Large Cap Biopharmaceutical Companies?

Caution: Risk Aversion Remains High

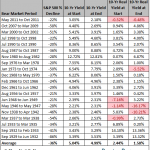

Investing in biotech stocks ain’t getting easier. The sector is underperforming the market by 16% YTD, sentiment has been burned by concerns about drug pricing and even the spectre of a Fed rate rise, with potentially less available equity funding, has hit all stocks. To beat the market in 2016 you need to select specific stocks that have value, dividends and a near term pipeline. The objective here is to select 3-4 large cap biopharmaceutical stocks that can beat the IBB. Now that the speculative fever has subsided large caps can provide growth and safety.

We are reviewing financial metrics and valuations of large cap biopharmaceuticals to develop a portfolio that could supplement the IBB. The IBB is down 22% YTD compared to 9% for the broader based XLV healthcare ETF. When all reporting is complete this week we will compare valuations and growth prospects balanced by technicals which are very important in a bear market.

As of 1/31/16 YTD here is the 2016 stock performance, and followed by 12 month performance:

Amgen (AMGN) down 5.91%, up 0.31%

Abbvie (ABBV) down 7.33%, down 9%

Bristol-MyersSquibb (BMY) down 9.64%, up 3.14%

Biogen (BIIB) down 10.9%, down 29.8%

Leave A Comment