Yesterday a paper came out by John Williams and Thomas Laubach called, Measuring the Natural Rate of Interest Redux. They presented their model to determine the natural real rate of interest. In short, their model gives a steadily low natural real rate that would justify keeping nominal interest rates low.

Paul Krugman jumped on board and used the paper to support his views that the Fed should continue to keep the Fed rate on the zero lower bound. He said…

“Laubach and Williams find that the natural rate has plunged in recent years, and is now very, very low. The particular statistical method they use is reasonable…”

“L-W attribute the decline in the natural rate largely to the slowing of potential output, which in turn reflects demography and what looks like a slowdown in technological progress. That’s more speculative. But the low natural rate is as solid a result as anything in real time can be.”

Hold on a second, I see a problem with the statistical method. The method is not reasonable. As well, their result is not as solid as anything that can be in real time. I will compare their method to the “real time” method from my research in effective demand.

The main problem that I see is that their method is based on the trend growth rate of potential GDP. I do not agree with the CBO’s estimate of potential output. I have my own estimate based on unemployment, capacity utilization and labor share. These variables give data in real time month to month, except for labor share which is released every 3 months.

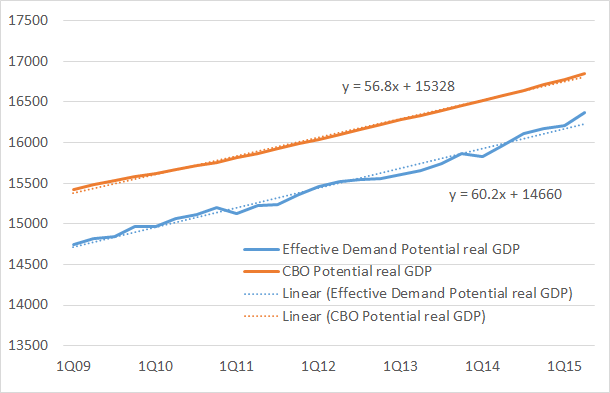

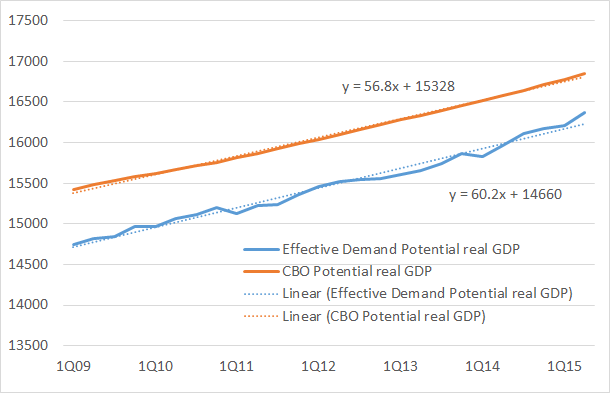

Here is a graph comparing the CBO’s potential GDP with the one that I calculate using effective demand.

The linear trend line for the CBO potential has a slope of 56.8, while the slope of my potential is 60.2. My trend line shows potential output growing faster than the CBO’s. Thus I end up calculating a higher natural real interest rate than Laubach and Williams. And if we look at the comparison just since the 1st quarter of 2014, we see an even stronger difference.

Leave A Comment