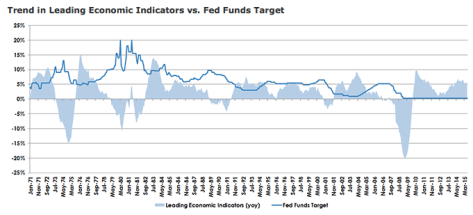

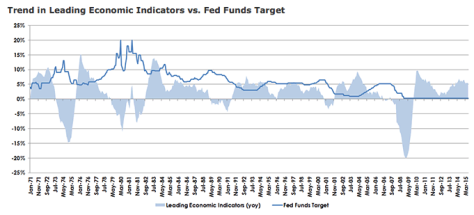

According to the amalgamation of ‘Leading Indicators’ to the economy, it is time for a rate hike. Here is the graph of LI and Fed Funds, from Wisdom Tree’s post on the subject.

It is and has been also time to hike based on employment numbers. This was supposed to be the last thing to get squared away before normalization, wasn’t it? LI is thought to lead inflation in the economy, which has thus far been held in check by a global deflation that is devouring funny munny sprayed from global policy hoses.

Inflation has been held in check unless you look at services from healthcare to electricity, which keep on climbing. So there is pressure there. More inflationary implication comes from this Fed graph by way of the Daily Shot.

From DS: “The arguments for a September rate hike are fairly weak, given weak inflation expectations and a strong dollar. Some at the Fed are focused on trying to get “ahead of the curve”, expecting wage growth to begin accelerating. One such argument for example is the unemployment rate approaching NAIRU (the unemployment rate below which inflation theoretically should pick up).”

Complicating the picture are these pesky things, from U Michigan by way of DS showing that the downturn in the stock market has punched a hole in the public’s inflated balloon of fun and happiness. One measly little correction and this harpooning the public’s faith in the stock market and its own prospects for comfortable retirement?

Why so fragile, anyway? Oh wait, never mind. I am sure the Fed did not purposely target a wealth effect in the stock market. It just happened, as if by magic.

Leave A Comment