Paul Tudor Jones once said, “You look at every bear market and they’ve always basically occurred because of an uptick in inflation and an uptick in interest rates.”

PTJ is right… Those of you familiar with our debt-cycle framework know that the Fed drives the business cycle by raising or lowering the cost of money (interest rates). And the Fed bases its rate decisions off of its two mandates (1) maintaining full employment and (2) and stable prices (ie, 2% inflation target).

These two mandates are intimately connected. A tight labor market drives wage pressures as businesses are forced to pay up for scarce labor. These increased costs eventually get passed to the consumer in the form of higher priced goods and services (ie, inflation).

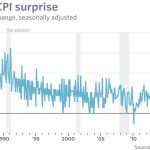

Higher inflation leads to more aggressive rate hiking by the Fed which tightens liquidity, squeezes risk-premiums, and turns the debt cycle over into a short-term deleveraging.

The GOAT (aka, Stanley Druckenmiller) laid out in a Barron’s interview from the late 80’s exactly how this process plays out. He said, with emphasis by me:

The major thing we look at is liquidity, meaning as a combination of an economic overview. Contrary to what a lot of the financial press has stated, looking at the great bull markets of this century, the best environment for stocks is a very dull, slow economy that the Federal Reserve is trying to get going… Once an economy reaches a certain level of acceleration… the Fed is no longer with you… The Fed, instead of trying to get the economy moving, reverts to acting like the central bankers they are and starts worrying about inflation and things getting too hot. So it tries to cool things off… shrinking liquidity…[While at the same time] The corporations start having to build inventory, which again takes money out of the financial assets… finally, if things get really heated, companies start engaging in capital spending… All three of these things, tend to shrink the overall money available for investing in stocks and stock prices go down…

Leave A Comment