Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem.

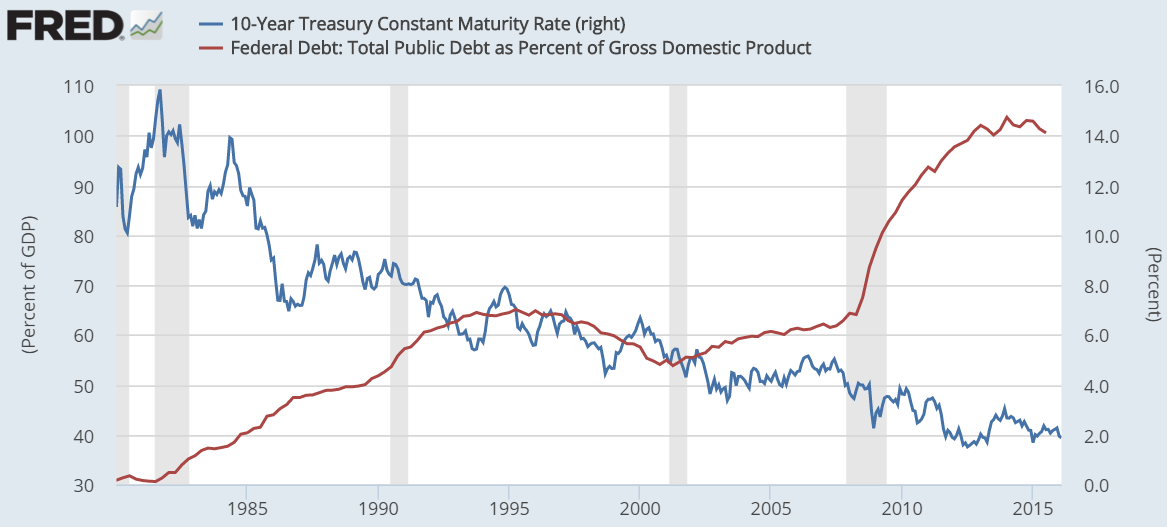

For instance, Ip says that “higher federal borrowing puts upward pressure on interest rates”. This is classic “crowding out”,an argument that has been thoroughly debunked in the last 20 years as interest rates have fallen despite soaring government debts around the globe.

(Higher interest rates are correlated to higher government debt?)

But the interest rate burden is a more common misconception. In “The Biggest Myths in Economics” I elaborate on this:

“The interest burden in the USA is actually declining as a % of GDP and is entirely controllable if the government desires. We pay about $250B in debt service every year. The Federal govt could actually reduce this substantially by reducing the maturity on their debt by issuing short-term debt instead of higher interest bearing long-term debt. They have complete control over their interest costs if they so desire.

There is no ironclad law that forces the US govt to raise interest rates if it doesn’t want to. Just look at Japan where interest rates have been zero for two decades. A government that is sovereign in its currency, has no foreign denominated debt and a central bank that can issue its own currency does not have to worry about someone else telling them that they need to raise their interest costs. This interest cost is not controlled by “the market”. It is controlled by the monopoly supplier of reserves to the banking system (the central bank) and the Treasury which dictates the average outstanding maturity of the liabilities it issues. So this too is not a realistic concern.”

Leave A Comment