QUESTION:

Dear Marty,

Please correct and expand my understanding of a Sovereign Debt Crisis as it pertains to leveraged accounts. If global economies are leveraged because of too much debt with no plans to pay, then what are the pros and cons to leveraged short investments when economies are deleveraging? Might they be dangerous at times?

Thanks in advance for your incredible knowledge and willingness to educate others wanting to learn and understand.

Sincerely,

BB

ANSWER: Leverage seems to be the buzz word everyone relies upon to predict the end of times. All we hear about is the leverage in derivatives and the issue that will collapse society. Quite frankly, that is a lot of hype. They are quoting the total gross without looking at the net because so much of this is offset.

Because of these scenarios, the predictions people tout is always inflation. They keep the German hyperinflation in mind even if they do not explain their base reasoning. However,LEVERAGE has existed since ancient times. Here is a Babylonian tablet recording the earliest futures market. Sorry, but LEVERAGE has been around a very long time.

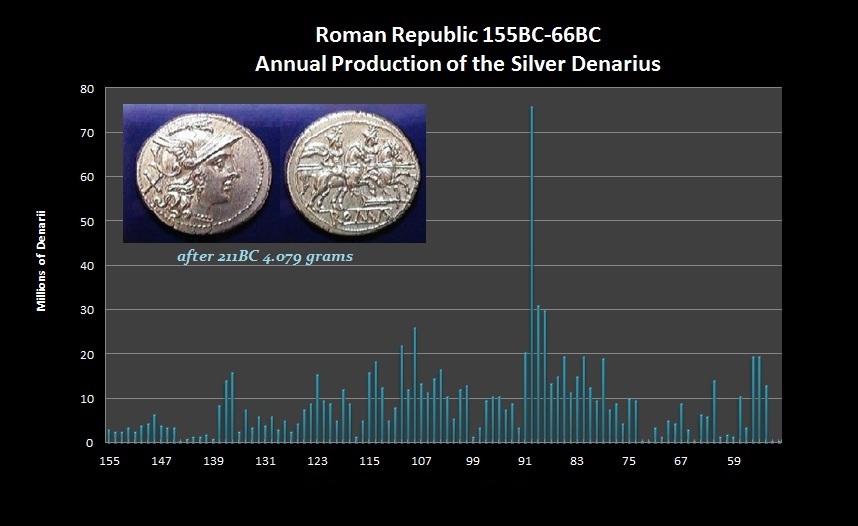

Careful correlations of historical data we have gathered which even include the money supply determined by the number of known dies for coins and the average 25,000 coins which can be struck before a die breaks. When I say we put together the largest collection of coinage providing a complete run back to 600BC to recreate the monetary system of the world, it is no exaggeration.

We even have Roman dies that were used to strike coins shown above and to the right. You cannot ascertain what the future will bring without a road-map of the past. Forecasting the future demands a database – not merely theories. By assembling the hardcore evidence of history tracing the footsteps of humankind throughout the centuries, only then can you speak with any pretense of authority that is not qualified with “I think”.

We even have Roman dies that were used to strike coins shown above and to the right. You cannot ascertain what the future will bring without a road-map of the past. Forecasting the future demands a database – not merely theories. By assembling the hardcore evidence of history tracing the footsteps of humankind throughout the centuries, only then can you speak with any pretense of authority that is not qualified with “I think”.

Leave A Comment