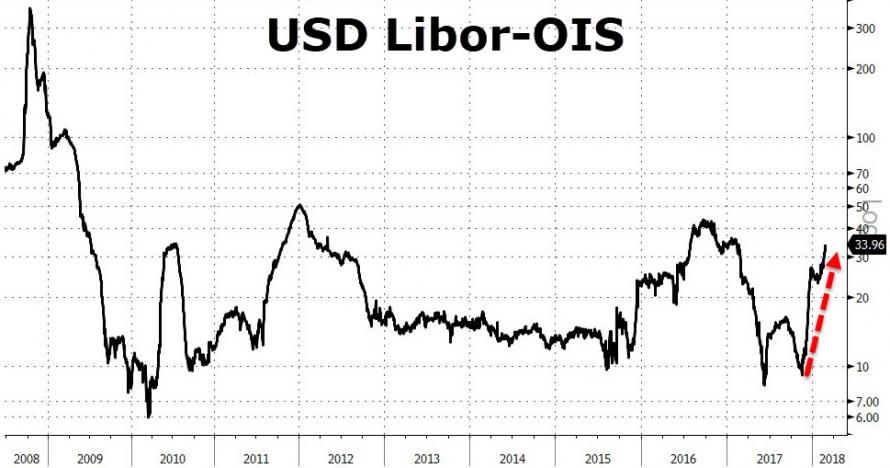

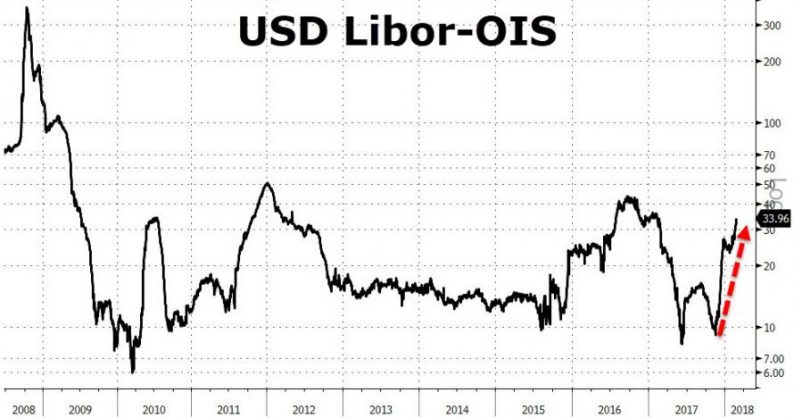

Earlier this week we noted that as trader attentions have been focused on more conventional indicators of market risk, the USD Libor-OIS spread – historical a sign of credit concerns – has been blowing up, widening the most since last Feb as Libor has continued to creep higher, while commercial paper rates for financials are also rising as more issuers have been selling longer-dated obligations, and moving closer on the curve.

Well, earlier today the USD Libor-OIS spread widened again, pushing to 35bp, from 34bp the prior session as three-month Libor rose for the 13th straight session.

Among the most immediate catalysts for the rise is that as Bloomberg noted this morning, BofA revised its 3M Libor forecasts higher, and now sees 2.6% at end-2018 assuming three Fed rate hikes in 2018, a higher Fed effective rate and “persistent tightness” in USD funding conditions. The bank also boosted its Libor-OIS spread forecasts based on said tightening in USD funding conditions “and its evolution over coming quarters” and now sees 31bp by end-1Q, 38bp by year-end.

The key question here, and one we asked on Wednesday, is “why is there persistent tightness” in USD funding conditions, and is there another dollar shortage quietly forming behind the scenes?

In short, and as explained in more detail previously, the answer may be yes, and the culprit is the same “echo taper” discussed here last year (and recently by Credit Suisse’s Zoltan Pozsar) , when we commented on the impact repatriation would have on rates, and especially the front-end.

To grossly simplify, what is going on is what as a result of the hundreds of billion in repatriated cash, many companies will use the newly unencumbered proceeds to repurchase debt and delever (if only on a gross basis). This has a direct impact on dollar funding markets, and specifically the Libor OIS, as financial markets are now losing one of the biggest providers of funding in the front-end. This is certainly the case in the corporate bond market, but also the commercial paper market, money market funds, CDs, securitized products and other fixed income asset classes.This was explained last October in “discussed here last year ”

Leave A Comment