TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

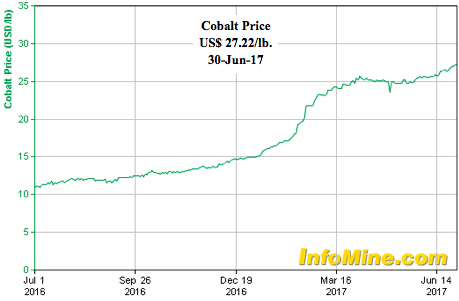

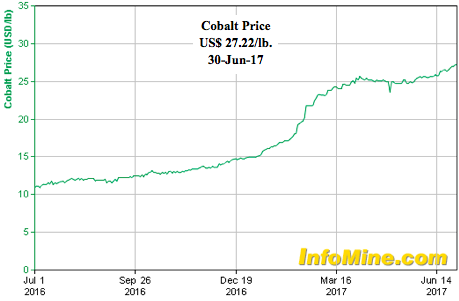

Two months ago I interviewed Dwayne Melrose, Director & Chair of the Technical Committee for LiCo Energy Metals [TSX-V: LIC / OTCQB: WCTXF]. Since then there has been a number of noteworthy press releases, and the Cobalt price continues to rise. In addition, Bearing Lithium’s 17.7% pro forma interest in a Chilean Maricunga project (a ~4,400 hectare project valued by the market at about C$280 M) is getting a major mineral resource upgrade this month, and a rumor that a Chinese PE firm might acquire up to 20% of NYSE: SQM sent Wealth Minerals’ shares up ~10% on July 5th.

Here’s a brief recap of 3 developments at LiCo from just the past 3 weeks….

As of June 22nd, Greg Reimer joined LiCo’s Advisory Board. Greg is EVP of BC Hydro’s Transmission & Distribution Network. BC Hydro is Canada’s 3rd largest Electric Utility with over 4 M customers and $5.7 billion in revenue. {See press release}

In a press release dated June 28th, LiCo announced that, in conjunction with the Purickuta project, it’s opening an exploration & development office in Santiago, Chile.

On July 5th, positive geophysical results were reported,

“Beneath the surface crust is detected a conductive unit with values of resistivity less than 1 ohm-m, (interpreted as brines) divided into 2 sub units; a high-conductivity saturated unit (0.4 to 0.9 ohm-m) 6.3 to 22 meters thick, and a very high-conductivity saturated unit (0.2 to 0.4 ohm-m) detected at two depths, the first under the saline crust with thickness of 3 and 7 m, then again under the unit of high-conductivity with a thickness of 100 m, not detecting the floor of this stratum,” (meaning beyond the detective depth capacity of the TEM survey).

Leave A Comment