Wide moat industrial stocks, such as defense contractor Lockheed Martin (LMT), often make excellent long-term dividend growth stocks.

In fact, Lockheed Martin is a dividend achiever with 15 straight years of consecutive dividend increases under its belt. Even better, the stock has managed to grow its payout at an impressive average annual rate of 10% over the past 30 years.

While Lockheed’s steady dividend increases have historically made it an attractive offering, past performance is not indicative of future results.

In addition to taking a look at the level of income growth investors can expect from Lockheed in the future, let’s also review the company’s competitive advantages and current valuation to see if Lockheed Martin could be a timely blue chip stock to consider for a diversified dividend growth portfolio.

Business Overview

Founded in 1909 in Bethesda, Maryland, Lockheed Martin is the world’s largest defense contractor and the biggest supplier of fighter aircraft. However, while the company is best known for the F-35 joint strike fighter, Lockheed Martin actually has four major divisions:

Aeronautics (39% of sales and 41% of operating profits year-to-date): designs, manufactures, and maintains combat and air mobility aircraft, including fighter jets (F-22, F-35, and F-16), military transport planes, and unmanned air vehicles.

Missiles and Fire Control (14% of sales and 21% of operating profits): provides air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems.

Rotary and Mission Systems (28% of sales and 17% of operating profits): builds and maintains military and commercial helicopters. Also designs ship and submarine mission and combat systems, including mission systems and sensors for rotary and fixed-wing aircraft, sea and land-based missile defense systems as well as radar systems, the Littoral combat ship, simulation and training services, and unmanned systems and technologies. This division also offers government cybersecurity services and specializes in military communication solutions.

Space Systems (20% of sales and 21% of operating profits): designs and builds satellites, strategic and defensive missile systems, and space transportation systems. This division is also where Lockheed designs its classified systems and services in support of national security.

Overall, Lockheed Martin generates 60% of its sales from the U.S. Department of Defense, 20% from U.S. government agencies, and 20% from international militaries.

Business Analysis

Many of the best dividend growth stocks generate growing and recurring sales, earnings, and cash flow, which are made possibly by durable competitive advantages that allow a company to protect its margins and returns on shareholder capital over time.

As an industrial company, and one that’s essentially 100% reliant on world governments for its business, Lockheed’s top line sales can be somewhat cyclical.

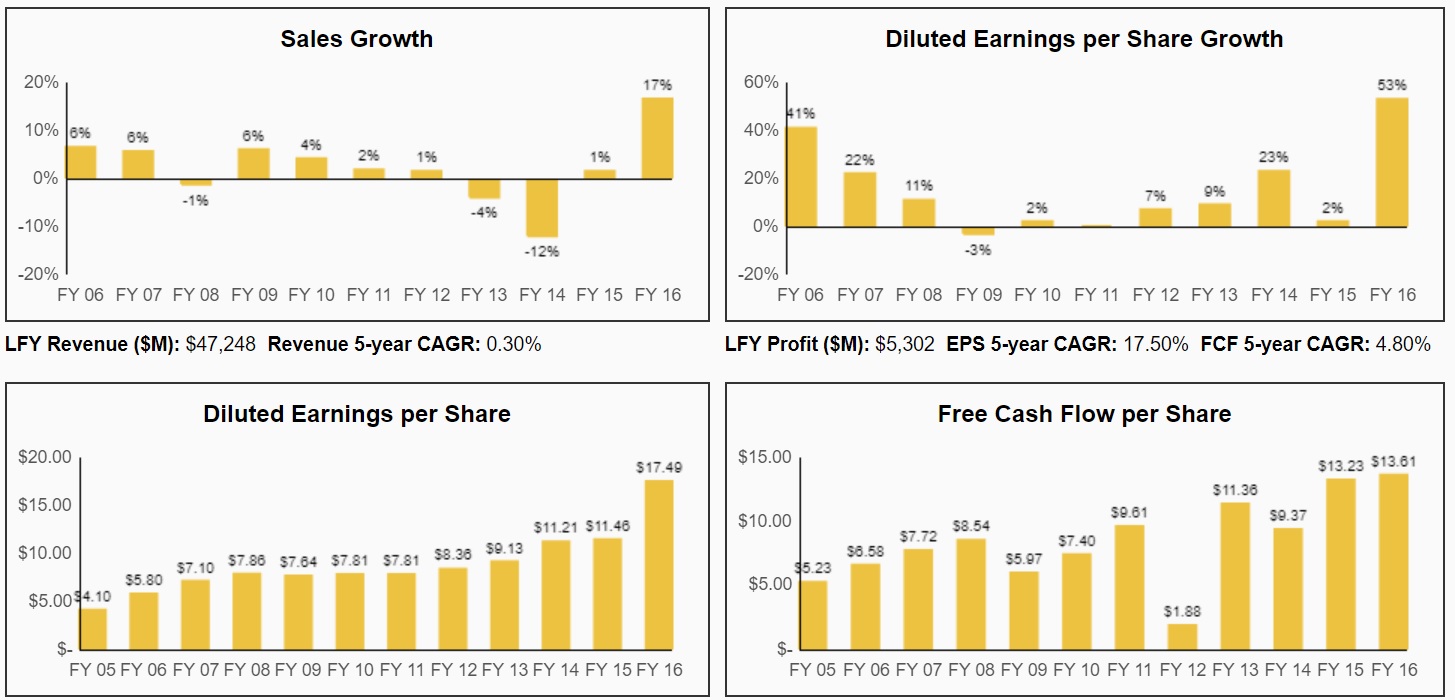

Source: Simply Safe Dividends

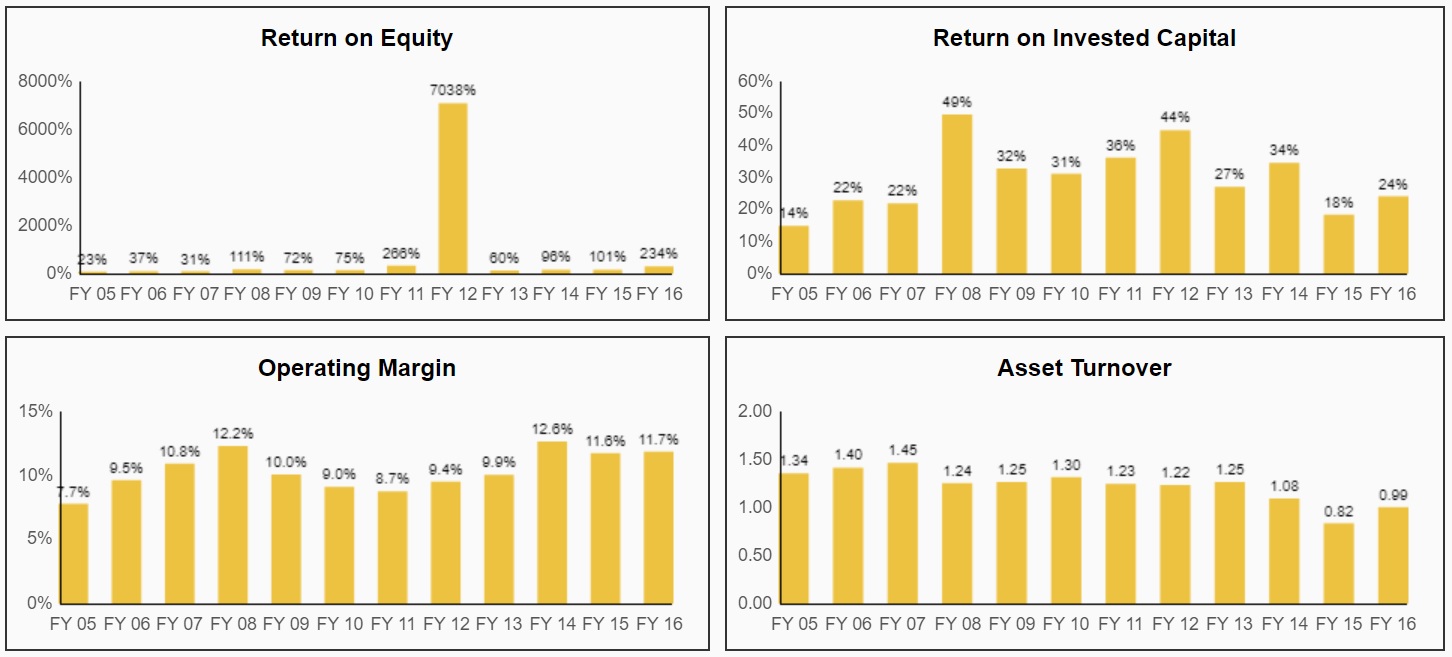

While the company operates in a highly capital-intensive industry, the nature of its military and government contracts also locks in relatively high profitability, resulting in cyclical but relatively stable and generous profits and returns on shareholder capital.

Stepping back, the nature of defense contractors can create substantial moats for some businesses. The highly complex and very expensive development costs of these weapons systems, as well as the Department of Defense’s (DOD) conservative approach to whom it works with (company trust, expertise, and reputation are everything in this business), mean that smaller, less well-capitalized rivals are essentially locked out of the market.

In fact, many of Lockheed’s DOD contracts are non-competitive, meaning the U.S. military has no choice but to use Lockheed because there are no other qualified bidders. In 2012, for example, Lockheed obtained $17.4 billion worth of non-compete contracts from the U.S. DOD, representing about 37% of that year’s revenue.

And thanks to its $9 billion acquisition of Sikorsky Aircraft in 2015, Lockheed now has a massive business building and servicing UH-60 Blackhawk helicopters, of which the U.S. military maintains a fleet of 2,000. Replacing, maintaining, and servicing this large sunk cost for the DOD means Lockheed enjoys large switching costs in military rotary aircraft as well.

The deal essentially added the world’s largest military helicopter maker by sales to Lockheed’s combat jet and missile-defense businesses. When combined with Lockheed’s divestiture of lower-margin government IT and services businesses, these moves further concentrated the company on military businesses with greater competitive advantages and improving growth prospects.

Lockheed’s moat is especially wide in manned combat fixed wing aircraft, where it’s likely to be the U.S. military’s sole supplier by 2025, thus ensuring a steady stream of high margin sales and cash flow.

Another benefit Lockheed has is that it sells internationally to allied militaries, very few of which have the expertise or desire to take the time and money required to design their own homegrown weapons systems.

Leave A Comment