London’s house market has been slowing for some time, as I noted last year. The issue is affordability. Artificially low interest rates make the monthly payment seem cheap. But the key question is whether your salary will allow you to repay the capital borrowed over time.

Sadly, this has become increasingly impossible for many actual and potential buyers, due to the Bank of England’s increasing use of stimulus policies since 2000.

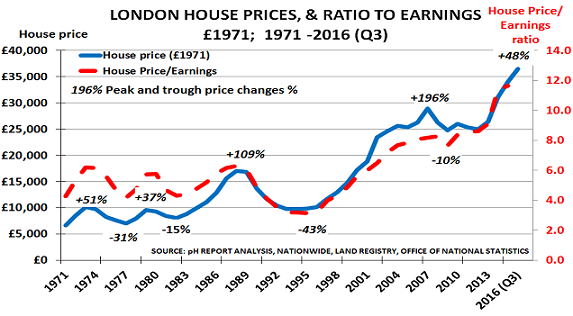

The chart shows house prices on the left, and the ratio to earnings on the right. (Prices are adjusted for inflation since 1971, to enable long-term comparison):

But after the dotcom crash in 2000, the Bank deliberately allowed prices to move out of line with earnings As the Governor, Eddie George, later told the UK Parliament in March 2007:

“When we were in an environment of global economic weakness at the beginning of the decade, it meant that external demand was declining… One had only two alternatives in sustaining demand and keeping the economy moving forward: one was public spending and the other was consumption….

“We knew that we had pushed consumption up to levels that could not possibly be sustained in the medium and longer term. But for the time being if we had not done that the UK economy would have gone into recession, just like the economies of the United States, Germany and other major industrial countries. That pushed up house prices and increased household debt. That problem has been a legacy to my successors; they have to sort it out.”

Of course, as the chart shows, George’s successors did the very opposite. Ignoring the fact that a bubble was already underway, they instead reduced interest rates to near-zero after the subprime crisis of 2008, and flooded the market with liquidity. Naturally enough, prices then took off into the stratosphere.

Leave A Comment