.. at least according to BofA’s latest, just released December monthly Fund Managers Survey, in which 172 participants with $480bn in AUM responded to dozens of questions, among which “what do you think is the most crowded trade.” Back in September, as we reported at the time, for the first time ever the top answer according to 26% of respondents, was “long Bitcoin.” Fast forward three months, when after Nasdaq topped the survey in October and November, being “long Bitcoin” is once again viewed as the most crowded trade according 32% of the respondents, followed by “Long FAANG+BAT” at 29%, and “Short Vol” in third with 14% of the responses.

Of course, this does not mean that everyone is long bitcoin; it just means that everyone thinks everyone else is long bitcoin.

Another notable December response: traders have never been more terrified by central bankers making a mistake and bringing the “market” house of cards crashing down; as a result “Fed/ECB policy mistake” has been the top tail risk for the past 3 months and four times in 2017.

Looking ahead, the smartest people on Wall Street said that over the next 23 months, rising wages will be the biggest enemy to the bull story, with 32% worried that an increase in compensation will crush corporate profits, with rising rates surprisingly all the way in third place (21% of respondents), while trade war has effectively dropped off the map with just 16% worried about protectionism and redistributionist policies.

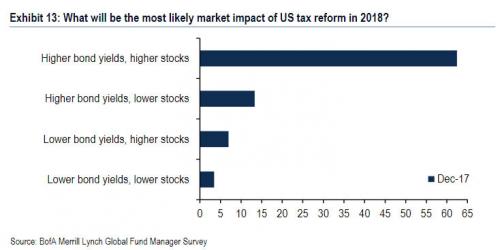

But fear not, because a whopping two-thirds of respondents, a stunning consensus for this survey, expect tax reform to result in higher bond yields and higher stocks, while only 3% think tax reform will lead to lower yields and lower stocks. Translation: one year from now stocks and yields will be far lower.

Leave A Comment