By Clayton Browne

According to research firm Natixis, the US dollar is likely to go on a significant run over the next few months given global economic headwinds ex-U.S., then starting sometime next year, the dollar will begin a long, slow slide as the global economy retrenches and gathers pace.

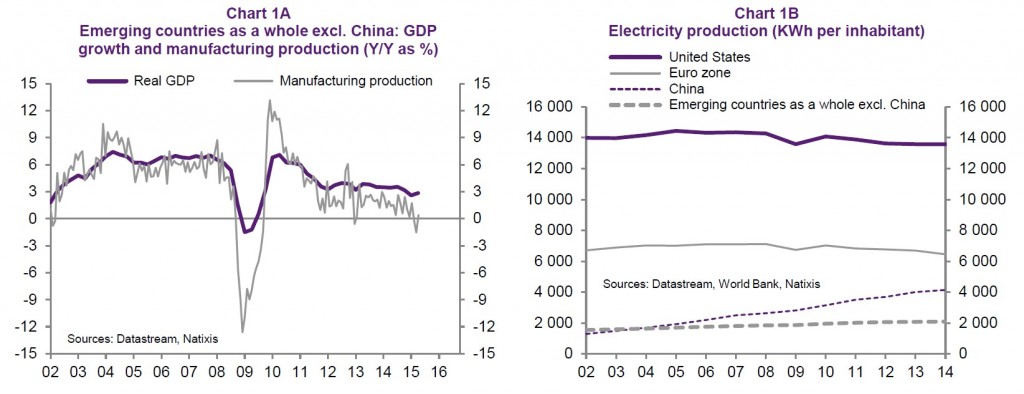

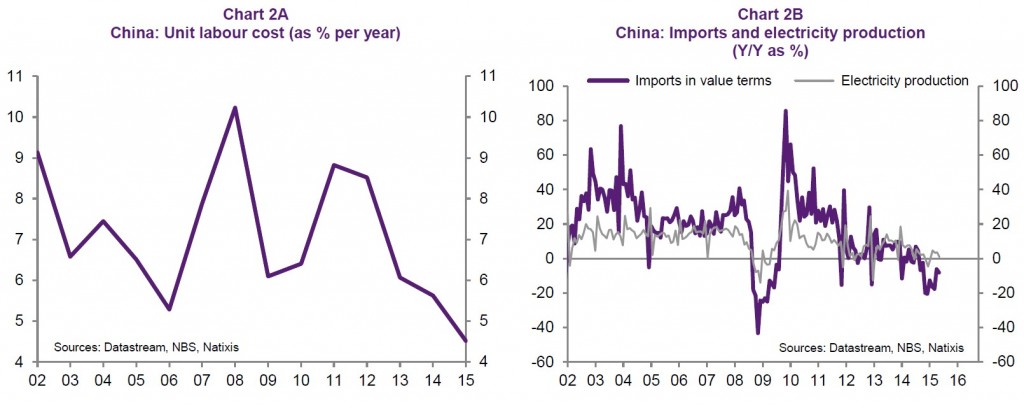

Natixis Economic Research analyst Patrick Artus argues that emerging countries other than China are seeing negative impacts from supply and financing bottlenecks that are limiting economic growth, China is rapidly losing its competitiveness, Japan has distorted income distribution in favor of companies, commodity-exporting EMs are being hammered by very low commodity prices (with no sign of let up), and the euro zone remains hamstrung by years of weak investment. This leaves the U.S. in the catbird seat, so to speak, and will probably lead to a notable appreciation in the greenback over the next couple of quarters, according to Artus.

Resuscitating U.S. economy will lead to strong US dollar over the near term

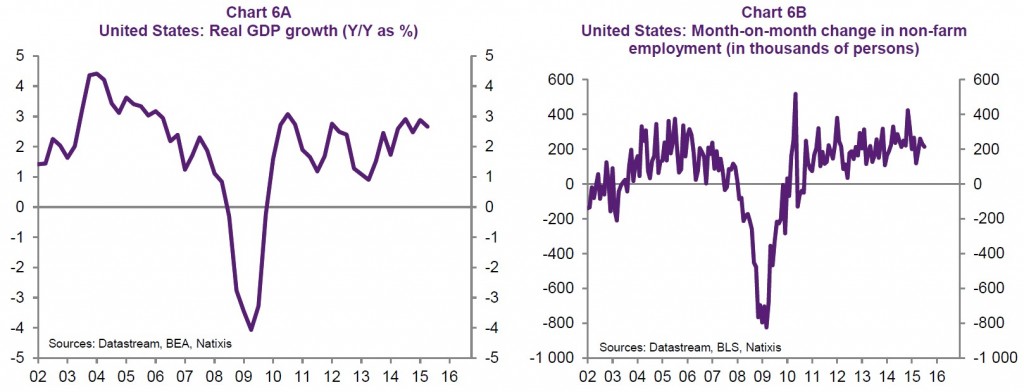

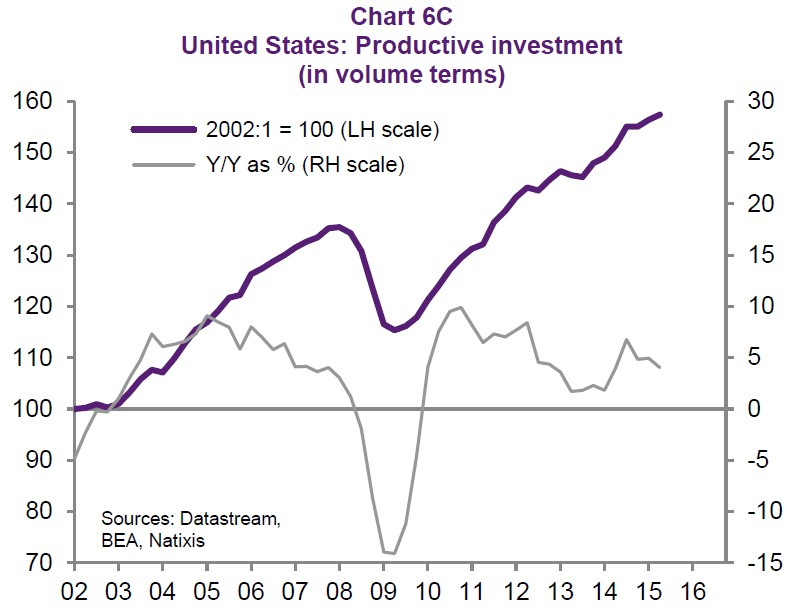

Artus says that the U.S. is now the global economic top dog again, and that will lead to positive capital flows and before long a stronger US dollar. “The United States, which enjoys robust growth, even though it is being weakened by a few negative factors (low skills of the jobs created, oil sector crisis, decline in productivity gains), has therefore once again become the most attractive country in the world, and therefore ought to attract capital from the rest of the world.”

Global economy ex U.S. facing headwinds

As described briefly in the introduction above, nearly all sectors of the global economy ex-U.S. are currently dealing with some sort of structural macroeconomic headwinds, so even though the U.S. economy is really just barely revving up into second gear right now, most of the rest of the world is still stuck in neutral. That means that the U.S. is where many will want to deploy their capital.

Leave A Comment