“Gold’s an inflation hedge.” How often have you heard that old saw? And is it really true?

Perhaps if you take the long view, it is true. But you have to take an exceptionally long view to see this.

Since the dollar was allowed to float free of gold in 1971, the Consumer Price Index (CPI) has climbed over 500 percent. In that same time, gold’s price has risen about 3,000 percent. Bullion’s eye-popping return certainly seems to have beaten the Dickens out of inflation over the past 47 years. But here’s the deal: What if your hedging horizon is less than four or five decades?

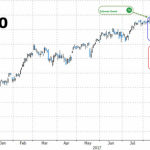

Check the chart below and you’ll see periods where gold seriously underperformed inflation. The interregnum between November 1980 and July 1982 saw a 74 percent drubbing of the gold price as the CPI rose 13 percent. Between March 1996 and January 2001, gold sank 34 percent while the CPI climbed 12 percent. Then there was the period between November 2012 and December 2015. Gold gave up 46 percent then. Inflation was tame at that time, creeping up less than 3 percent.

Overall, there’s only a 17 percent correlation between the inflation index and gold’s price. For a hedge, that’s not a good fit. Hedging is time-dependent: There are good times to hedge and there are bad times. Clearly, the true benefit of tying up assets with a gold hedge is derived when bullion turns bullish. Otherwise, assets like stocks or bonds—income-producers devoid of carrying costs—outpace inflation better.

That’s not to say that gold and inflation are unrelated. Gold is highly correlated to real interest rates and the reality of interest rates is determined by factoring in the effect of inflation. Or inflationary expectations.

Inflationary expectations, measured by the breakeven inflation (BEI) rate at least, have been pushed upward over the past six months. The BEI rate is the difference between the nominal yield on a conventional Treasury security and that of an inflation-protected note or bond of the same maturity. If inflation averages more than the BEI rate, the inflation-linked security will outperform the conventional note or bond. If inflation trends lower than the BEI rate, the traditional fixed-rate security will come out on top. It’s important to know that the BEI is just real-time expectation, not a forecast.

Leave A Comment