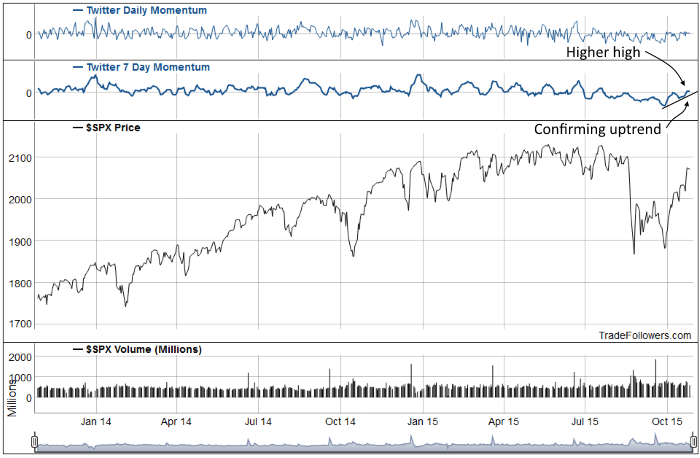

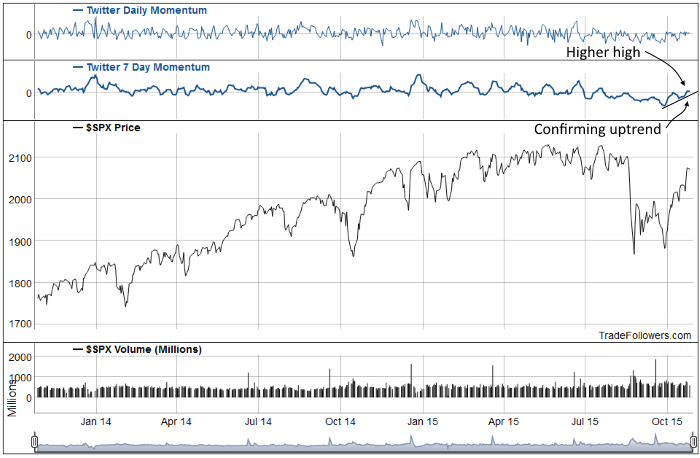

Momentum and sentiment for the S&P 500 Index (SPX) is slowly turning back to bullish. It’s been a tough road, but it looks like market participants are starting to get comfortable in the current range. 7 day momentum is holding its confirming uptrend line and has now put in a higher high…even if it’s barely above zero. It’s a small positive, but encouraging if it can hold.

SPX paused for a couple of days just below major resistance at 2040 then blasted through it and the next level at 2060. It is now consolidating above both new support lines. A consolidation back to the 2040 area would be healthy as long as it holds.

Click on image to enlarge

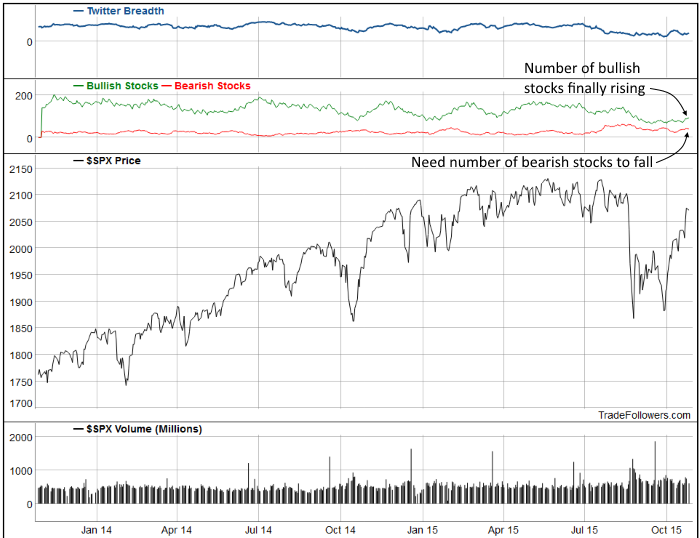

Breadth is slowly ticking up due to the number of bullish stocks rising…finally. Now we want to see the number of bearish stocks fall.

Click on image to enlarge

Conclusion

Overall sentiment for the market is looking better. We’re not out of the woods yet, but with 7 day momentum back above zero, SPX above major support, and the number of bullish stocks starting to rise we’ve got a good start. The odds are tilting back in favor of the bulls.

Leave A Comment