The Canadian Dollar dropped, testing the lows of 2018, following CREA data showing existing home sales crashed to the lowest since 2013 and price appreciation slowed dramatically.

Home sales via Canadian MLS® Systems were down 6.5% in February. This marks the second consecutive monthly decline following the record set in December 2017 and the lowest reading in nearly five years.

February sales were down from the previous month in almost three-quarters of all local housing markets, with large monthly declines in and around Greater Vancouver (GVA) and Greater Toronto (GTA).

Toronto home sales are down 8.2% MoM!

Vancouver home sales are down 15.8% MoM!

Actual (not seasonally adjusted) activity was down 16.9% year-over-year (y-o-y) and hit a five-year low for the month of February. Sales also stood 7% below the 10-year average for the month of February. Sales activity came in below year-ago levels in 80% of all local markets in February, including those nearby and within Ontario’s Greater Golden Horseshoe (GGH) region.

“The drop off in sales activity following the record-breaking peak late last year confirms that many homebuyers moved purchase decisions forward late last year before tighter mortgage rules took effect in January,” said Gregory Klump, CREA’s Chief Economist.

“Momentum for home sales activity going into the second quarter is also likely to weighed down by housing market uncertainty in British Columbia, where new housing polices were introduced toward the end of February.”

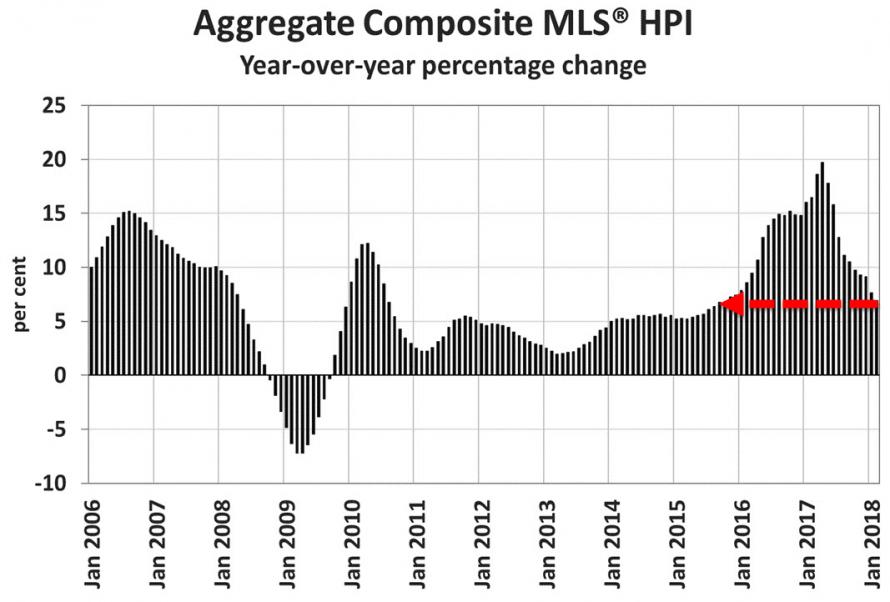

Furthermore, CREA that the Aggregate Composite MLS® HPI rose by 6.9% y-o-y in February 2018. This was the 10th consecutive deceleration in y-o-y gains, continuing a trend that began last spring. It was also the smallest y-o-y increase since October 2015.

and the kneejerk reaction in the market is to sell the Loonie, now trading back at 2018 lows – the lowest since July 2017..

Leave A Comment