Following yesterday’s record-breaking, blockbuster 10 Year auction it would have been difficult to follow the unprecedented scramble for benchmark OTR paper, and sure enough it was.

Moments ago the Treasury sold $15 billion in 30 Year paper in what may have been one of the weaker ultra-dated bond auctions in recent months, when it printed at 2.615%, tailing the When Issued by 0.7 bps, the first 30Y tail since February, and about 2 bps higher than the 30Y auction in April.

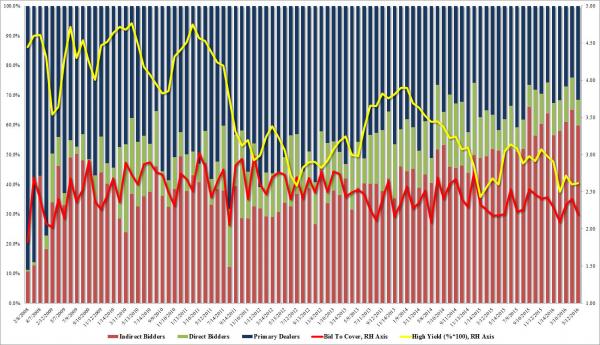

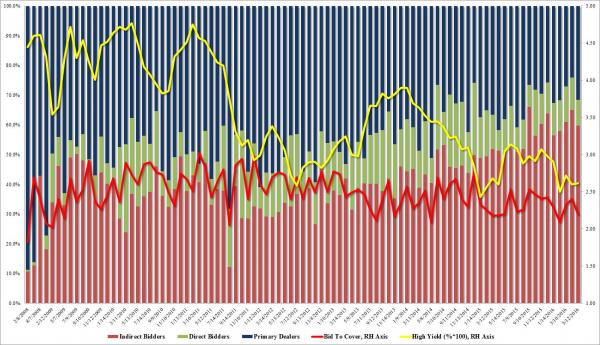

The internals were likewise weak: the bid to cover was only 2.199, well below the 2.40 in April and the lowest since February. Finally, the allocation did not inspire much confidence, with Indirects taking down 59.7% which while hardly low, was certainly nowhere near the record we saw in yesterday’s 10 Y auction. With Directs allotted 8.8%, or the lowest since last September’s 7.4%, this meant that Dealers were left with 31.5%, the most since February.

Why the disappointment? Perhaps because there were no 50 or 100-year bond sales in Europe today; or perhaps all the duration demand had exhausted itself yesterday. Whatever the reason, following the unexpected revulsion in stocks today, the mood appears to have shifted to the Treasury complex as well, which has seen some weakness following today’s auction.

Leave A Comment