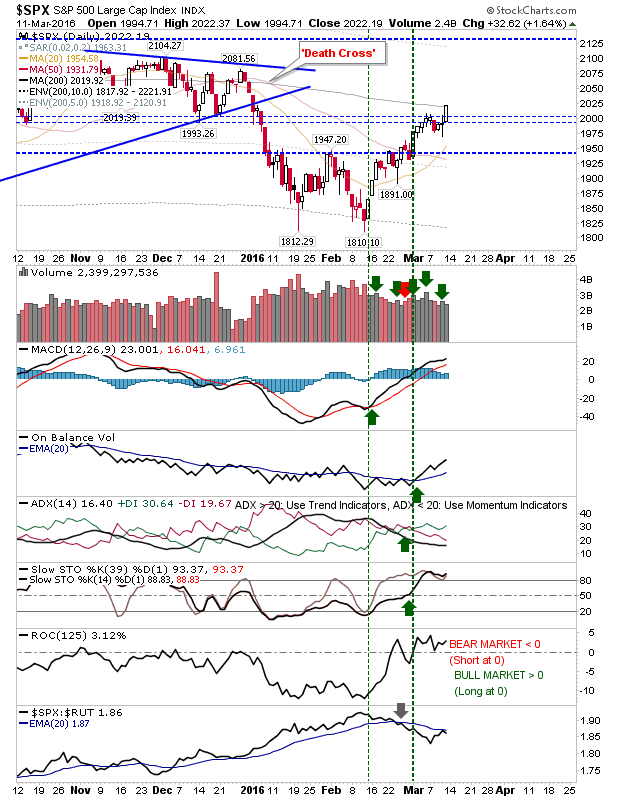

A brief update as work travel keeps me away from my blog. A strong finish to the end of week was tempered by the relatively light volume which came with the buying.

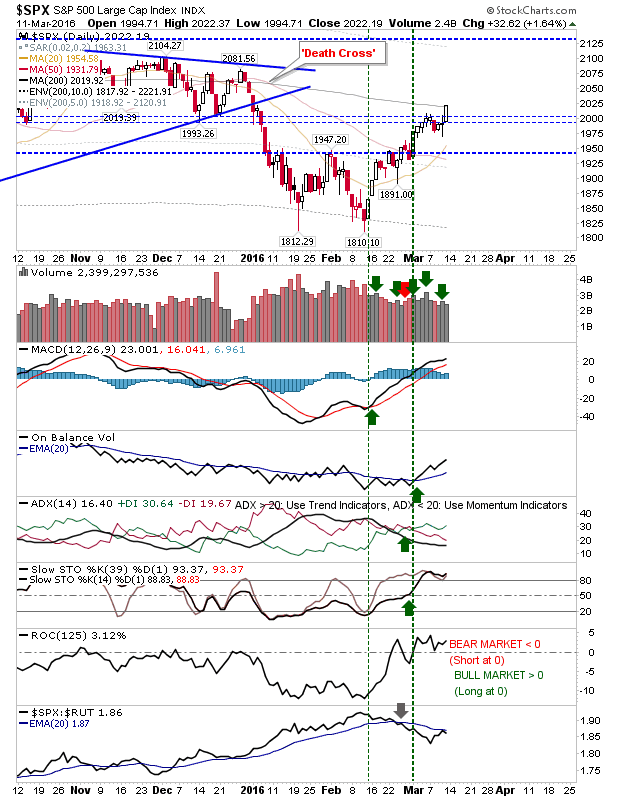

The S&P knocked on the door of the 200-day MA on solid technical strength. It will be important for buyers to keep buying pressure on as they look to push beyond and challenge 2015 highs. The index is also challenging relative performance gains as the maturing rally looks to see profit takers rotate out of speculative Small Caps into ‘safer’ Large Caps.

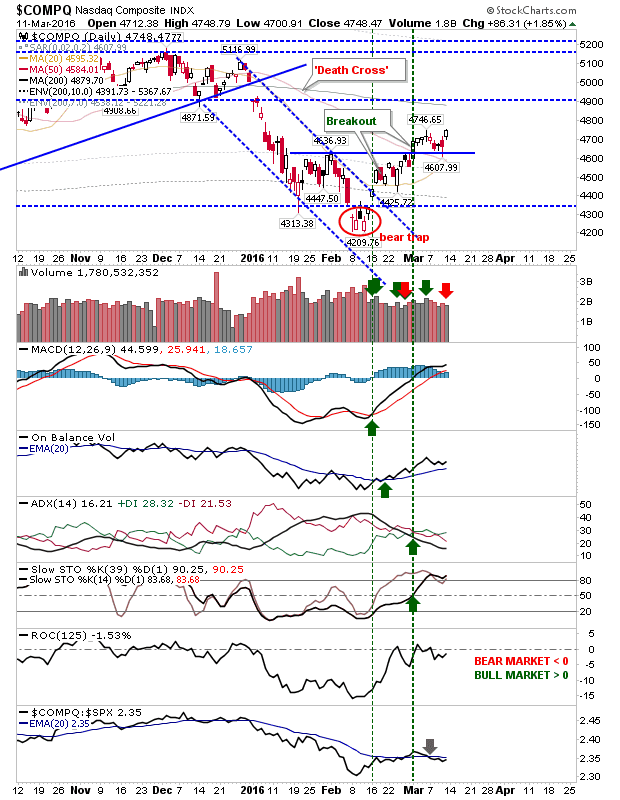

The Nasdaq managed a new swing high after a successful test of 4,535. It still has room to run before it gets to its 200-day MA. Tech averages have started to drift in technical strength, which may prove problematic if this trend continues for the coming weeks.

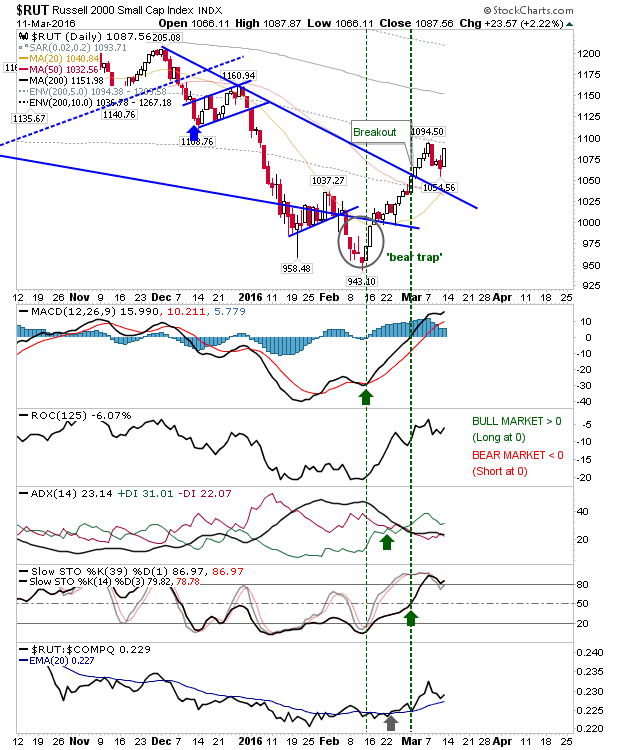

The Russell 2000 has enjoyed a solid advance from February lows with sharp outperformance against other indices. While latter strength has weakened, it’s still on the positive side of the 20-day MA. Friday was one of the best for indices, but it still has plenty of room to run before it gets to the 200-day MA.

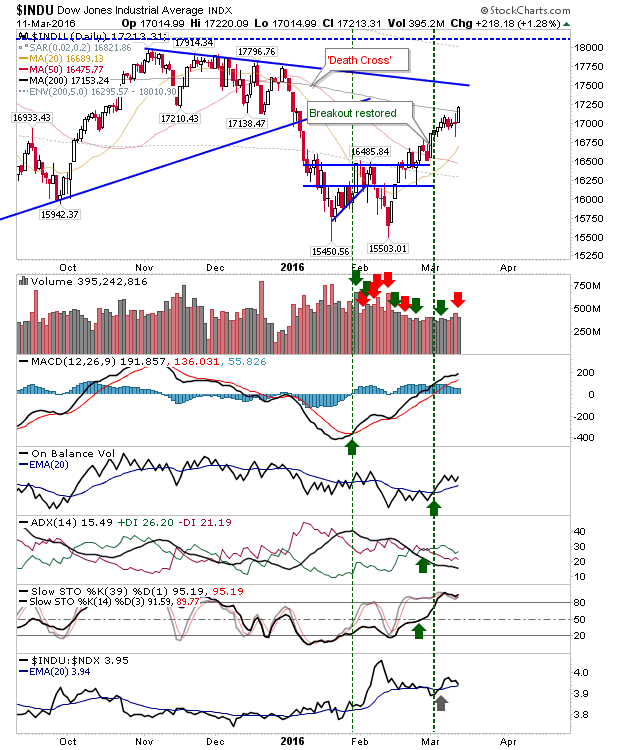

The Dow was able to inch above its 200-day MA as relative performance starts to drift lower. It could be the first index to test declining resistance from 2015 highs.

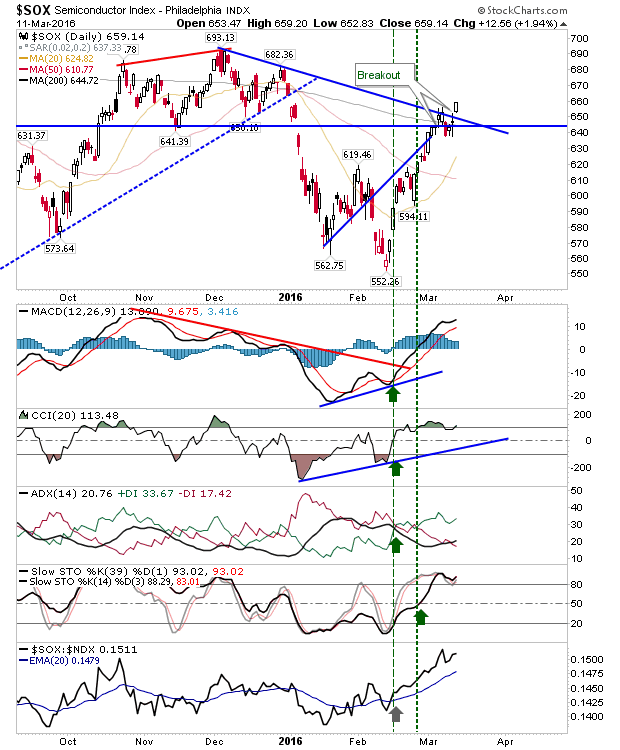

Good news for Tech indices is the breakout in Semiconductors. It has surpassed declining resistance from December highs, and is trading above its 200-day MA. This should help Tech indices continue their rallies.

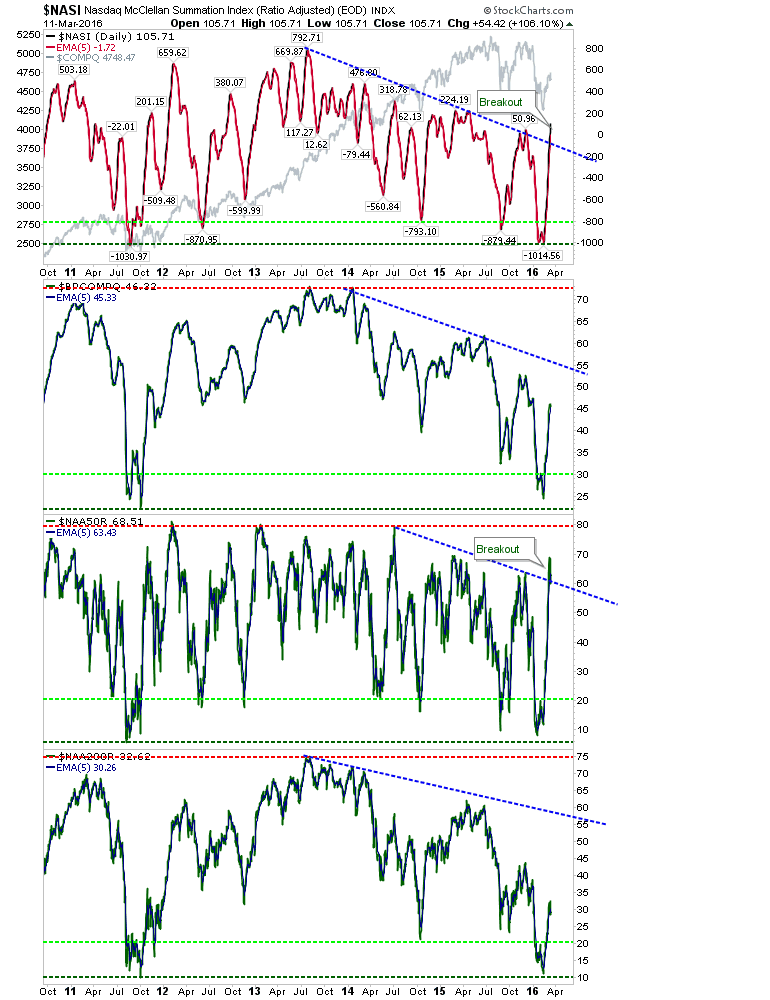

Nasdaq Sector breadth has seen increased strength and resistance breaks for the Summation Index and the Percentage of Nasdaq Stock above the 50-day MA. Bulls can look to these breaks as follow through opportunities for the Nasdaq and Nasdaq 100.

These are important times for the indices. Getting back to 2015 levels will effectively treat the 2016 sell off as an extreme bullish consolidation, which at the time had looked like anything but. If this is the case it would make the 2009/16 rally extremely long in the tooth, and a 40%+ trim from highs could not be ruled out sooner rather than later.

Leave A Comment