Few would argue with the returns that Lululemon Athletica (LULU) has given shareholders this year. And, few would assert that their financial metrics are anything but excellent. Yet, with the stock hitting all-time highs, it’s worth asking whether the current stock price is justified. Given that the apparel industry is incredibly trendy, subject to boom and bust, Lululemon would only be able to defend its current stock price relative to its peers by maintaining both its margins and growth. However, there are a few warning signs the company may not perform well in the future, as well as is overvalued at current levels.

Profitability

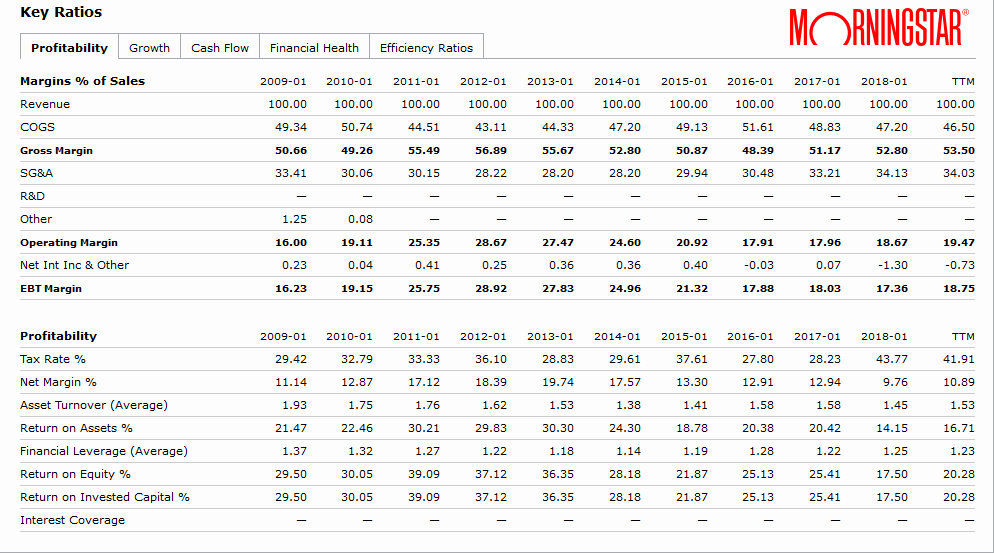

One of the potential problems facing Lululemon is the rise in its SG&A costs. While gross margin continues to climb, the ratio of SG&A to revenues has slowly climbed from a low of 28.2% in 2014 to 24.03%, the highest of the decade. If you only looked at the margins, you would likely miss this piece as the increases in gross margin have outpaced the climb in SG&A, which has also led to an increase in operating margin.

It’s worth taking a moment to discuss the tax rate percentages. The company realized a one-time expense of $59.3M related to the reforms in the US tax code. However, executives still expect to have a 30% effective tax rate in 2018, which is a full percent higher than they originally forecasted. In part, this is why the net margin appears so poor for 2018 and TTM.

Lastly, two items, in particular, stand out that show the company may not be as effective as it once was. Both the ROIC/ROE and ROA measurements sit at some of their worst levels in a decade. On top of that, in the last 5 years, revenues have grown $1.3B or 93%, and the lease expense has increased by $84M or 100%. When you consider this in tandem with the climbing SG&A costs, it gives the impression that with the company focused on their ivviva business, they may be slipping on maintaining their efficiency.

Leave A Comment