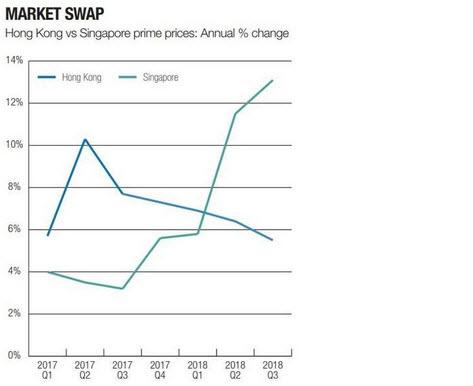

Singapore has now overtaken Hong Kong as the top city for luxury home price gains in Q3.

Luxury home prices in Singapore were up 13% in the third quarter from the year prior, according to Knight Frank LLP’s Prime Global Cities Index. The rising prices were partly the result of a limited supply of higher end properties.

Hong Kong instead fell to 14th place, with just a 5.5% year-over-year gain during the third quarter.

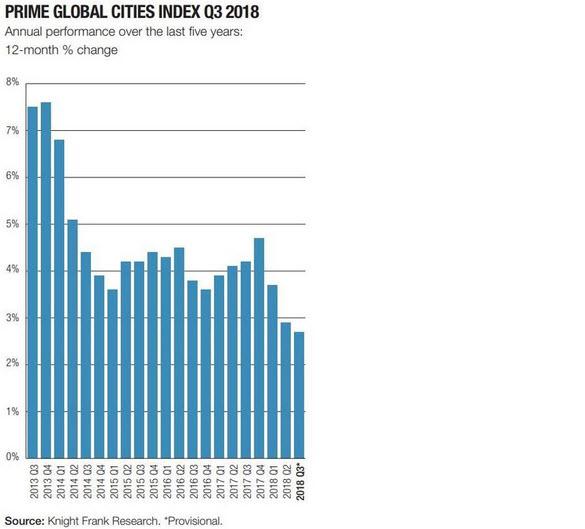

And the rise in Singapore does little to offer a picture of what the luxury property market looks like globally. Worldwide, luxury properties rose by just 2.7% on average across the 43 cities that make up the index – this is the weakest performance in annual terms in almost 6 years.

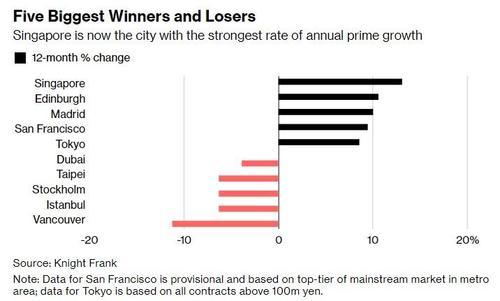

Cities like Edinburgh and Madrid found themselves in the top five, while London wound up moving into negative territory, watching prices fall 2.9% as a result of the continuing uncertainty around Brexit. Cities like Paris and Berlin posted steady gains of 5.6% and 5.4%, respectively.

Also among the decliners was Dubai, where prices fell 3.8% resulting in the middle eastern city being the fifth worst on the list. Stockholm, Istanbul, and Taipei all registered 6.3% year-over-year declines, tying them all for second worst place.

Finally, pulling up the rear is Vancouver, where we have spent time documenting a collapsing real estate bubble over the last couple of months. Vancouver saw its luxury home prices down 11% as more affluent pockets of the city, like West Vancouver, saw a pronounced slowdown in sales.

At the beginning of October, we asked readers what happens when prices rise so high that a chasm forms between bids and asks in Vancouver? The market grinds to a halt.

That’s what happened in September, when according to the Real Estate Board of Vancouver (REBGV), residential property sales tumbled by 17.3% from August 2018, and a whopping 43.5% from one year ago. In fact, a total of only 1,595 transactions took place as both buyers and sellers continue to sit on their hands amid confusion whether the recent torrid price gains will continue or whether the housing bubble has burst.

Leave A Comment