Welcome to another installment of Macro Mondays! It occurred to me recently, that I never discussed one of the quintessential asset classes for investors: real estate. While it’s nice to be able to afford pieces of physical property as an investment, sometimes that’s not always the case.

There is an easy way for ordinary investors to have exposure to the real estate market…and it doesn’t involve buying a piece of property that requires maintenance or mowing the front lawn every week. Enter, the REIT!

What is a ‘Real Estate Investment Trust’ or ‘REIT’?

A REIT is a type of security that invests in real estate through property or mortgages and often trades on major exchanges like a stock. REITs provide investors with an extremely liquid stake in real estate. They receive special tax considerations and typically offer high dividend yields.

Why do REITs make great investments?

REITs, an investment vehicle for real estate that is comparable to a mutual fund, allowing both small and large investors to acquire ownership in real estate ventures, own and in some cases operate commercial properties such as apartment complexes, hospitals, office buildings, timberland, warehouses, hotels and shopping malls.

All REITs must have at least 100 shareholders, no five of whom can hold more than 50% of shares between them. At least 75% of a REIT’s assets must be invested in real estate, cash or U.S. Treasurys; 75% of gross income must be derived from real estate.

REITs are required by law to maintain dividend payout ratios of at least 90%, making them a favorite for income-seeking investors. REITs can deduct these dividends and avoid most or all tax liabilities, though investors still pay income tax on the payouts they receive. Many REITs have dividend reinvestment plans (DRIPs ), allowing returns to compound over time.

What is the history of REITs and how were they started?

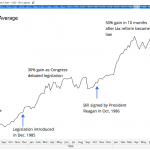

REITs have existed for more than 50 years in the U.S. Congress granted legal authority to form REITs in 1960 as an amendment to the Cigar Excise Tax Extension of 1960. That year The National Association of Real Estate Investment Funds, a professional group for the promotion of REITs is founded. The following year it changed its name to the National Association of Real Estate Investment Trusts (NAREIT).

Leave A Comment