Many MLP management teams have pursued growth at the expense of honoring their promise of stable distributions. We think the sector’s persistently high yields need explaining.

Although Kinder Morgan (KMI) got there through a series of steps, ultimately they redirected cashflows from distributions to new projects. From an NPV standpoint, financial theory holds that investors should be indifferent to how a company deploys its cash as they can always manufacture their own dividends by selling some shares.

Markets don’t work that way. Capital investments are not an expense, they’re a use of cash. But the dividend cuts required to fund them were treated as a drop in operating profit by investors. KMI should have understood this, because for many years prior to 2014 they sought investors who valued stable dividends. KMI then decided they no longer wished to appeal to those investors, and their valuation still reflects the betrayal. The bitterness of many investors is on full display via the comments on last Sunday’s blog.

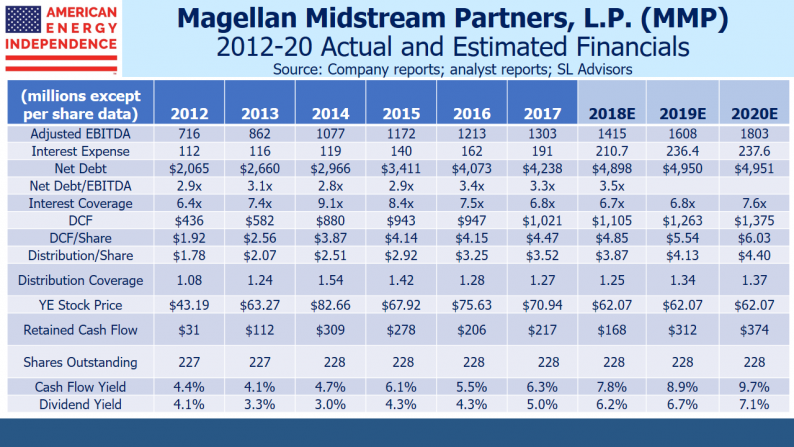

KMI’s problem of an undervalued stock is self-inflicted – but what about other MLPs who have been faithful to their income-seeking investor base? Magellan Midstream (MMP) does all the right things:

Such judicious capital management has probably caused MMP to pass on growth opportunities that others have chosen. Energy infrastructure analysts widely hold that the sector remain undervalued. Dozens of MLP distribution cuts are at least part of the reason – so a company that has remained steadfast should stand out.

But while MMP’s unwavering embrace of its principles has helped, it hasn’t been enough to truly separate them from their less reliable peers.

Leave A Comment