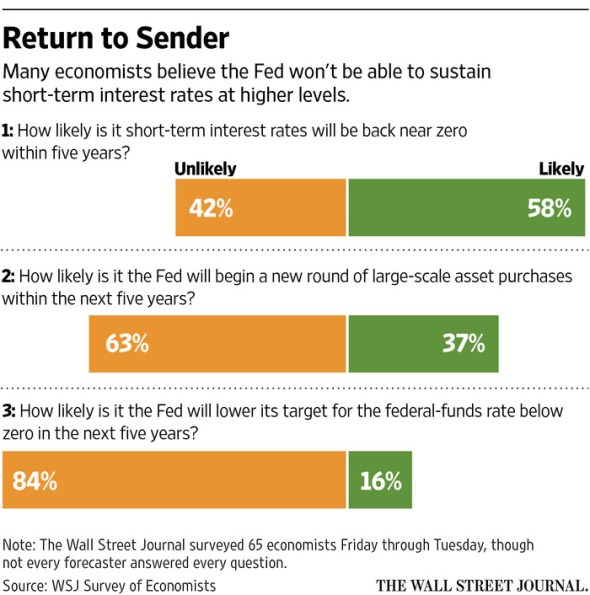

The Federal Reserve’s Federal Open Market Committee will kick off its December meeting Tuesday. Most pundits seem to think the Fed will raise the benchmark short-term interest rate from near zero to 0.25 on Wednesday. But many economists agree with Peter Schiff that even if the Fed ticks the rate up this week, it won’t stick.

Originally, conventional wisdom held the first rate hike would represent “liftoff.” It would signal the beginning of a series of hikes that would bring the rate back to “normalcy.” But as Peter Schiff pointed out last week, the Fed has walked back expectations. Instead of a liftoff, it is now signaling something that looks more like a hoverboard:

I believe that if the Fed raises rates by 25 basis points…as everyone expects it will, that the move will likely represent the END of the tightening cycle, not the beginning. (As I explained in my last commentary, the current tightening cycle actually started more than two years ago when the Fed began shortening its forward guidance on quantitative easing). The expected rate hike this month has long been referred to as ‘liftoff’ for the Fed, an image that suggests the very beginning of a process that eventually puts a spacecraft into orbit. But, in this case, liftoff will be far less dramatic. I believe the Fed’s rocket to nowhere will hover above the launch pad for a considerable period of time before ultimately falling back down to Earth.”

In the latest episode of The Peter Schiff Show, Peter expanded on this theme. He likened the Fed’s maneuverings to playing chicken with the stock market. He pointed out that all of the forward-looking economic signals point toward recession. But the Fed has backed itself into a corner. It almost has to raise rates slightly because it has created this expectation. Failing to nudge rates up would signal lack of confidence in an economy that the government has sold as recovered.

Leave A Comment