Just a few months ago, mainstream analysts were calling gold a “barbaric relic.” Now all of a sudden, they are saying, “Buy gold!”

Last Friday, Deutsche Bank issued a note asserting that with emerging economic risks and market turmoil, signs point in gold’s favor:

There are rising stresses in the global financial system…Buying some gold as ‘insurance’ is warranted.

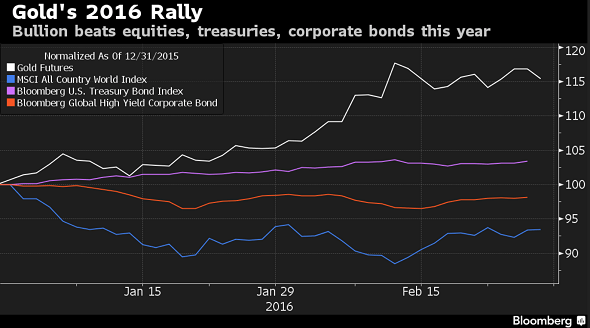

Deutsche Bank isn’t alone in singing gold’s praises. A Bloomberg report crowned gold “the biggest winner of 2016,” noting it’s posted 15% gains so far in 2016:

Turmoil across global equity and currency markets has sparked demand for a haven. Speculators raised their net-long position in gold to the highest in a year.

Bank of America Merrill Lynch analysts said, “Gold is the new black,” pointing out three-week inflows into the metal from investors are running at the highest levels since the middle of 2009.

As we’ve been pointing out, negative interest are good for gold. Currently, rates are below zero in the Eurozone and Japan. Negative rates could be in America’s future as well. The Deutsche Bank note echoed this line of thinking, noting gold looks good even with rising prices:

A bit like insurance, which is often a grudge purchase for many, some investors may balk at the current levels. We would, however, argue that given the plethora of negative deposit rates globally, the holding cost of gold is now negligible in many jurisdictions, and therefore gold deserves to be trading at elevated levels versus many other assets.”

Economic fundamentals are driving gold’s rally. Even while mainstream economists and Federal Reserve officials keep saying the economy is doing fine, investors recognize warning sings indicating a major recession is on the horizon. They are seeking a safe haven to preserve wealth. Bloomberg analysts even acknowledge this reality now:

Leave A Comment