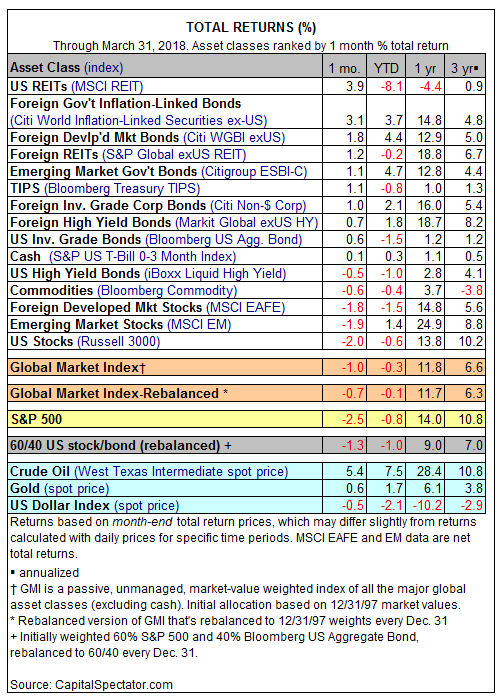

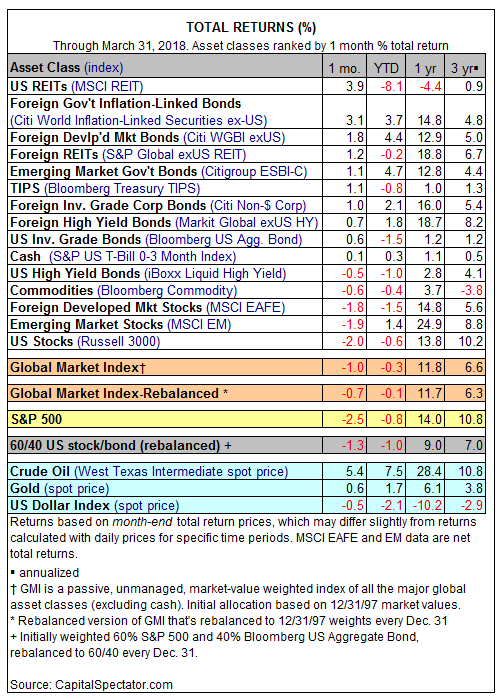

The major asset classes delivered mixed performances in March. Stocks in the US and foreign markets fell while US real estate investment trusts (REITs) and foreign inflation-linked government bonds posted the strongest gains.

The MSCI US REIT Index jumped 3.9% in March, the strongest advance for the major asset classes. The increase marks the first monthly gain for securitized real estate since November and the best gain for the index in nearly two years. Foreign inflation-linked bonds came in second in March’s performance race, rising a healthy 3.1%

US stocks suffered the biggest loss last month. The Russell 3000 Index slumped 2.0%, marking the first run of back-to-back monthly declines in over two years. In this year’s first quarter, US equities dipped by a fractional 0.6%

Due primarily to weakness in equities around the world in March, the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, shed 1.0% in March. GMI’s slide reflects a second consecutive monthly loss, the first time the benchmark has been down for two months in a row since late-2016. For the first quarter, GMI posted a slight 0.3% decline.

Leave A Comment