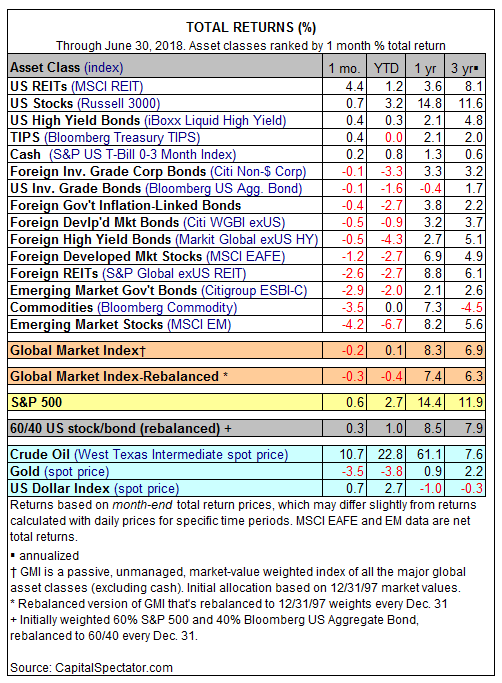

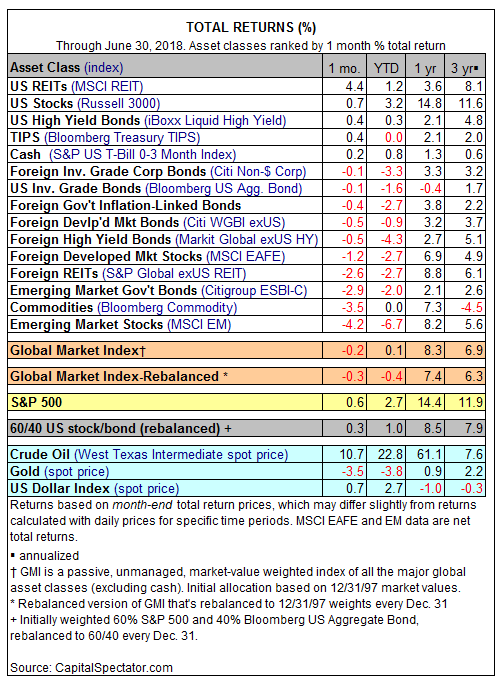

Real estate investment trusts (REITs) in the US posted the strongest gain in June among the major asset classes. The gain marked a second straight month with securitized real estate topping the performance list.

Although most market categories retreated last month, US REITs bucked the trend with a solid advance. The MSCI REIT Index increased 4.4% in June — the fourth consecutive monthly gain. Last month’s rally lifted the index to a new high for 2018 and close to the previous peak from last December. The asset class suffered a sharp correction in the first two months of this year, but since March US REITs have been rebounding. In three of the past four months, the index has been the top performer for the major asset classes.

Stocks in emerging markets suffered the biggest loss in June. The MSCI Emerging Markets Index tumbled 4.2% last month, the fifth straight monthly setback and the longest run of losses in nearly three years.

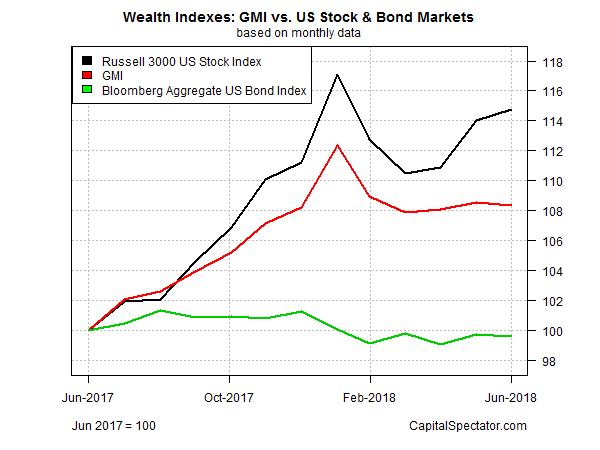

US equities managed to eke out a small gain in June. The Russell 3000 Index increased 0.7% last month – the third consecutive monthly advance. For the first half of 2018, Russell 3000 is up 3.2%.

Meantime, US bonds continued to drift lower. The Bloomberg Aggregate Bond Index ticked down 0.1% last month. Year to date, the index is off 1.6%.

The negative bias for markets overall last month clipped the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI fell 0.2% in June – the index’s first monthly decline since March. For the trailing one-year period, GMI remains firmly in positive territory, posting a healthy 8.3% increase over the year-earlier level.

By comparison, US equities (Russell 3000) are up 14.8% on a total return basis for the trailing one-year period while a broad measure of US investment-grade bonds (Bloomberg Aggregate) has lost 0.4% over the past 12 months through June’s close.

Leave A Comment