The flow of international trade has always been subject to geopolitical risk and conflicts. At all stages of the supply chain, trade inherently faces challenges posed by the geopolitical realities along a given route.

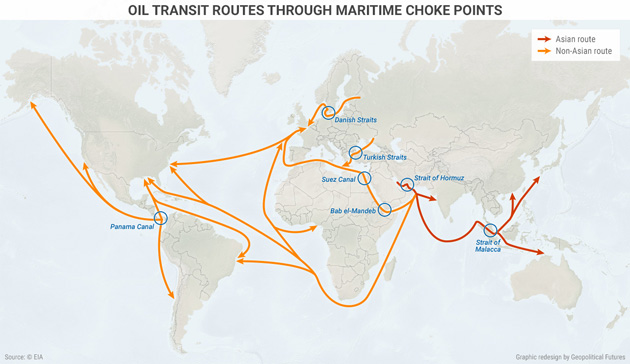

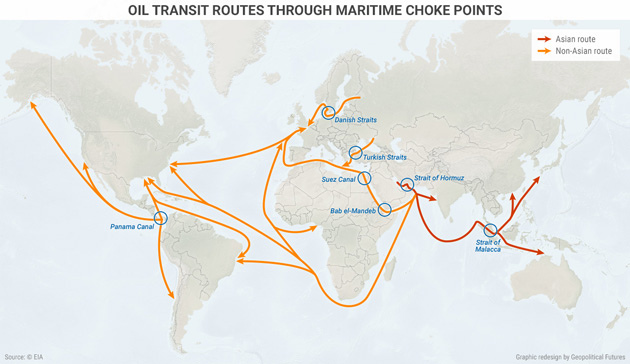

Some routes are more perilous and harder to navigate than others. One such trade route is the maritime path for delivering oil from Persian Gulf producers to East Asian consumers. It faces two critical choke points that are unavoidable given geographic constraints.

The Persian Gulf is a leading oil-producing region, accounting for 30% of global supply. Meanwhile, East Asia is a major oil-consuming region and accounts for 85% of the Persian Gulf’s exports, according to the Energy Information Administration (EIA). The most common route for oil deliveries between these two regions is through the Strait of Hormuz, into the Indian Ocean, and through the Strait of Malacca.

The two straits are geopolitical choke points because geographic limitations and political competition threaten access to these routes.

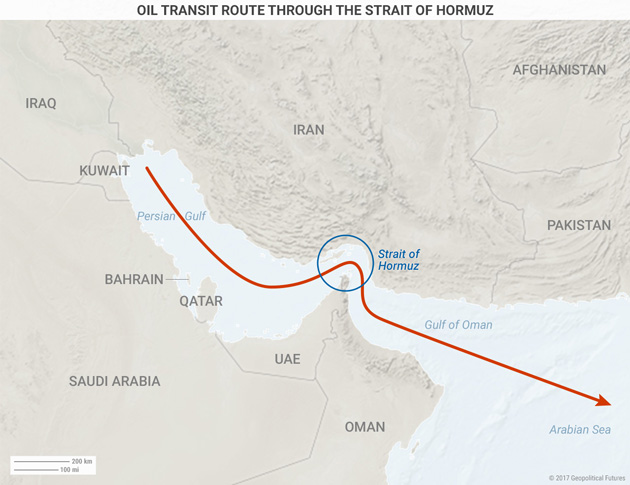

Strait of Hormuz

The Strait of Hormuz is the primary maritime route through which Persian Gulf exporters—namely Bahrain, Iran, Iraq, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates—ship their oil to external markets. Only Iran and Saudi Arabia have alternative access routes to maritime shipping lanes. The strait is 21 miles wide at its narrowest point, bordered by Iran and Oman. The EIA estimates that approximately 17 million barrels of oil per day—about 35% of all seaborne oil exports—pass through the strait. This path is also the most efficient and cost-effective route through which these producers can transport their oil to consumers in East Asia.

Persian Gulf countries depend heavily on revenue from these exports. For this reason, passage through the Strait of Hormuz is both an economic and a security issue for countries in the region. Disruptions in the strait would impede the timely shipment of oil: Exporters risk losing significant revenue and importers could face supply shortages and higher costs. The longer the disruption lasts, the greater the losses.

Leave A Comment