Monthly Labor Report

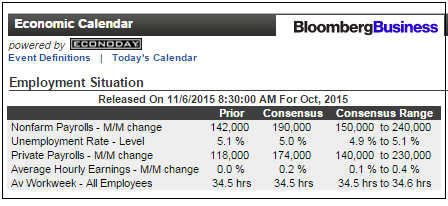

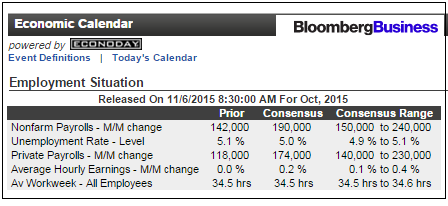

All eyes will be on this week’s monthly labor report. The report, which is due Friday at 8:30 am ET, may impact the outcome of the Fed’s December meeting.

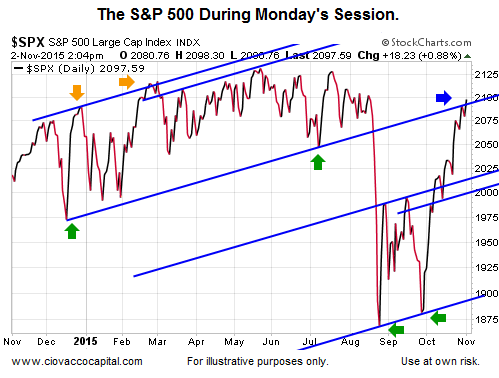

Friday’s non-farm payrolls report will also impact how the major indexes act near areas of possible resistance. Use this link to see a larger version of the chart below as of Monday’s close.

Is The Bigger Picture Starting To Favor Lower Lows?

This week’s stock market video looks at the market’s current risk-reward profile in the context of Friday’s late session sell-off and areas of possible resistance. The video also compares similarities and differences between 2011 and 2015.

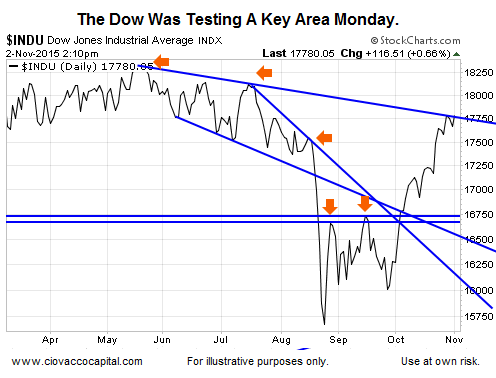

Industrial Stocks Also Near Important Area

Like the S&P 500, the Dow Jones Industrial Average is near a possible inflection point. Stock market bears prefer to see the index rejected near the upper downward-sloping blue line. Stock market bulls are pulling for the “breakout” scenario this week. Use this link to see a larger version of the chart below as of Monday’s close.

Investment Implications – The Weight Of The Evidence

There are three major scenarios facing the stock market:

Based on the facts we have in hand today, the higher probability outcomes appear to be 1 and 2 above. While the new low scenario’s probability is not zero, the weight of the evidence tracked by our market modelfavors bullish outcomes looking out several weeks/months. The previous sentences are subject to change if the data begins to deteriorate; something that has not happened yet in a meaningful way.

Leave A Comment