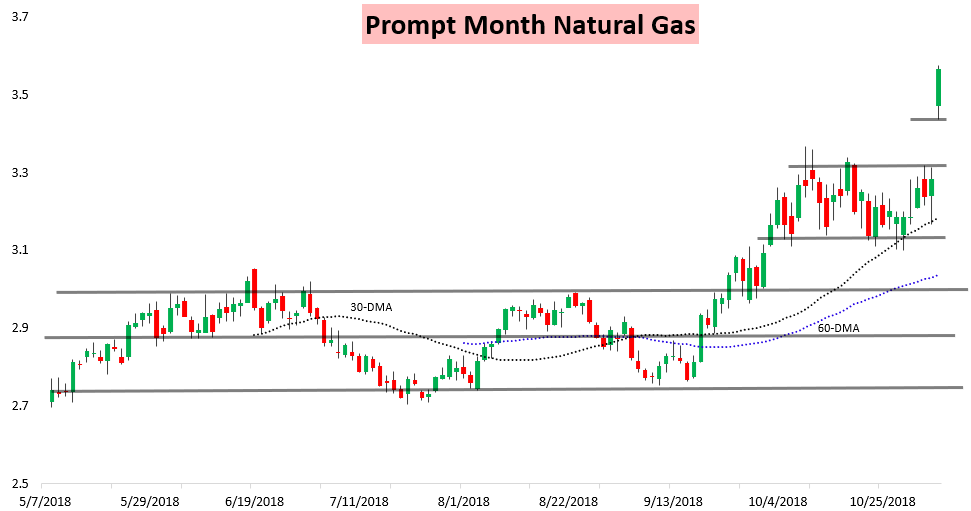

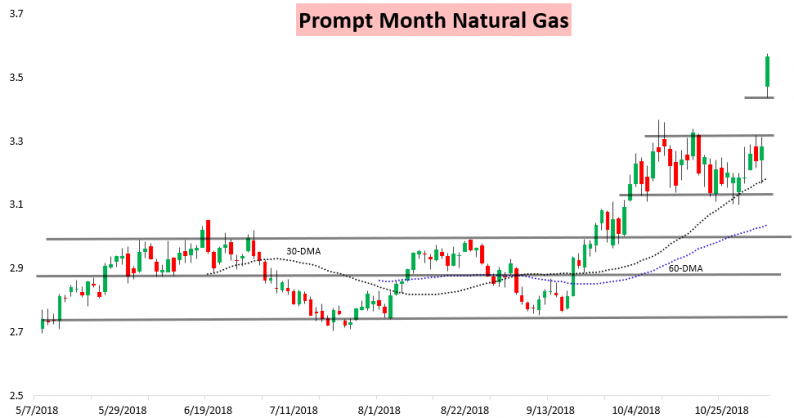

One of the largest weekend heating demand expectation additions in recent memory shot the front of the natural gas futures curve far higher this morning, with the December contract gapping massively up last evening and settling up over 8.5% on the day.

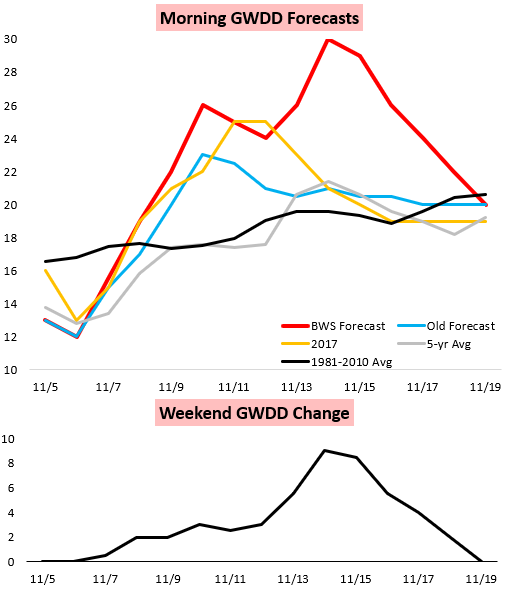

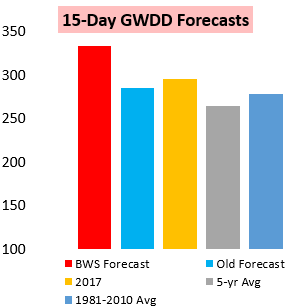

Our Morning Update for clients showed a massive increase in Gas Weighted Degree Days over the weekend.

This led us to hold a Slightly Bullish sentiment on the day even with the December contract already up 6.7% on the day.

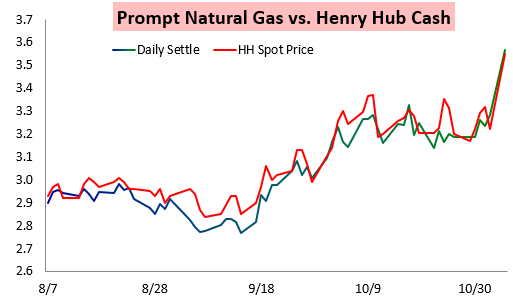

Sure enough, prices shot higher from there through the morning on significant strength in the physical market as well.

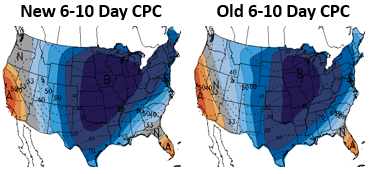

Climate Prediction Center forecasts have been trending colder in an effort to catch up with some of the very significant cold shown on model guidance.

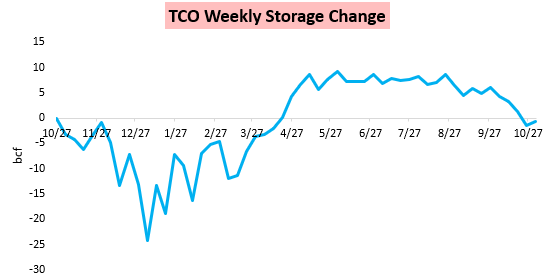

This comes after weaker cold has already been resulting in some storage draws across the East. Columbia Gas Transmission (TCO) reported a small draw of .64 bcf this past week, which was just a touch below the draw seen the week prior.

The intensity of this cold certainly caught many by surprise. Though we were not forecasting cold of this intensity, we closed our Pre-Close Update on Friday by highlighting huge uncertainties and risks into the weekend, “…confidence is very low due to this extreme model volatility…[w]ith risks that early Week 2 cold trends even stronger and that models still struggle to identify the pattern we expect, our sentiment is temporarily back neutral, as prices can temporarily run early next week on any colder trends before reversing once expected warmth arrives.” As seen this morning, those cold trends easily outweighed any warm risks.

Now traders are attempting to determine how long any cold will last and just how intense it will be. In our Afternoon Update we ran through the latest model guidance and gave our thoughts, and earlier today we released our flagship Natural Gas Weekly Update outlining how we expected weather model guidance to trend through the week and how that should move natural gas prices around.

Leave A Comment