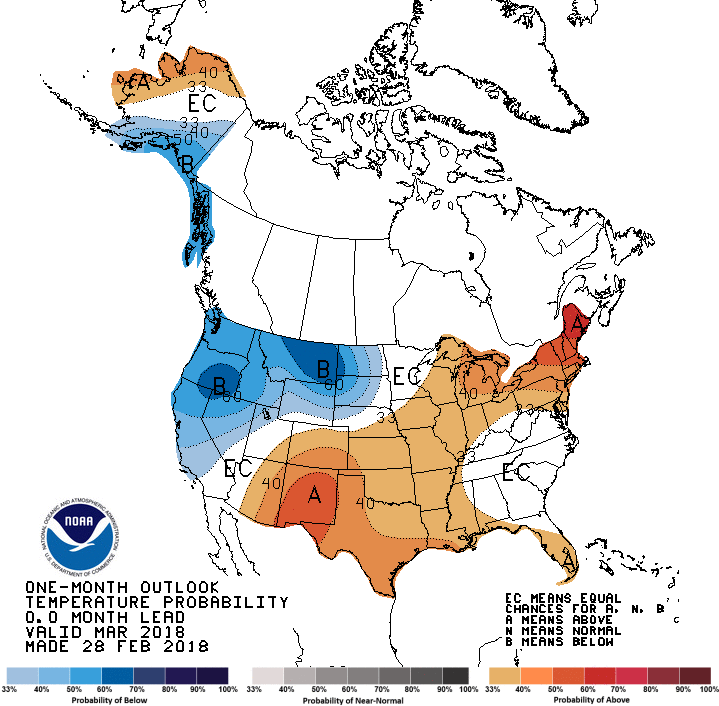

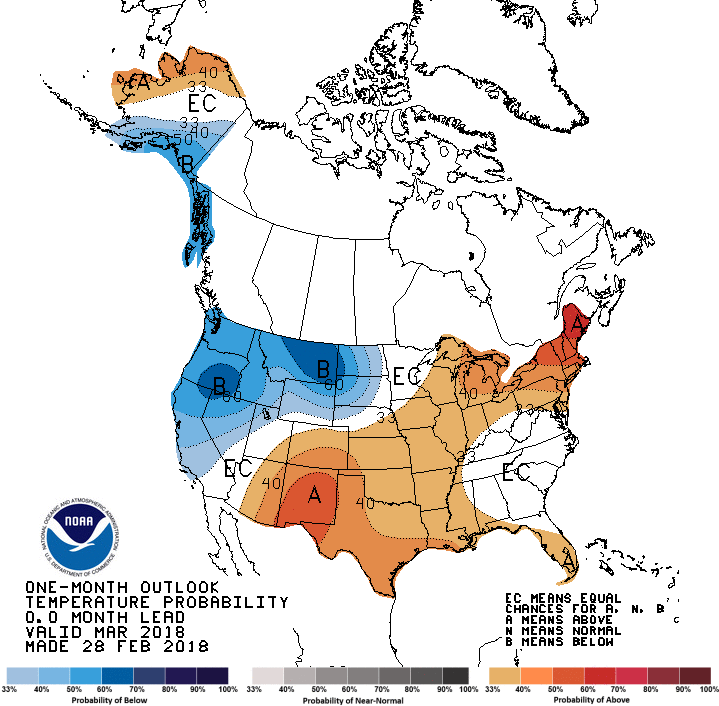

With March beginning tomorrow, the Climate Prediction Center issued their final forecast for the month. Generally, it shows warmth in South and Northeast with cold in the Great Plains and Pacific Northwest.

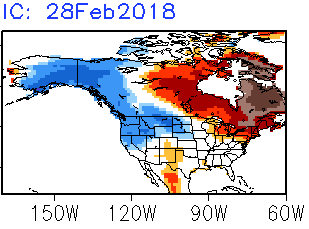

This certainly shares strong similarities with the final February run of the American CFSv2 climate model, per NOAA.

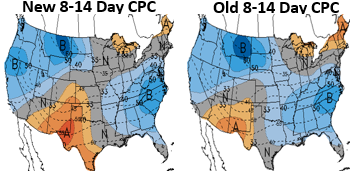

This would make it look like heating demand expectations through the month of March are relatively close to average. They also indicate that the second half of the month is likely warmer than the first, with the Climate Prediction Center updated 8-14 Day forecast still having decent cold nationwide.

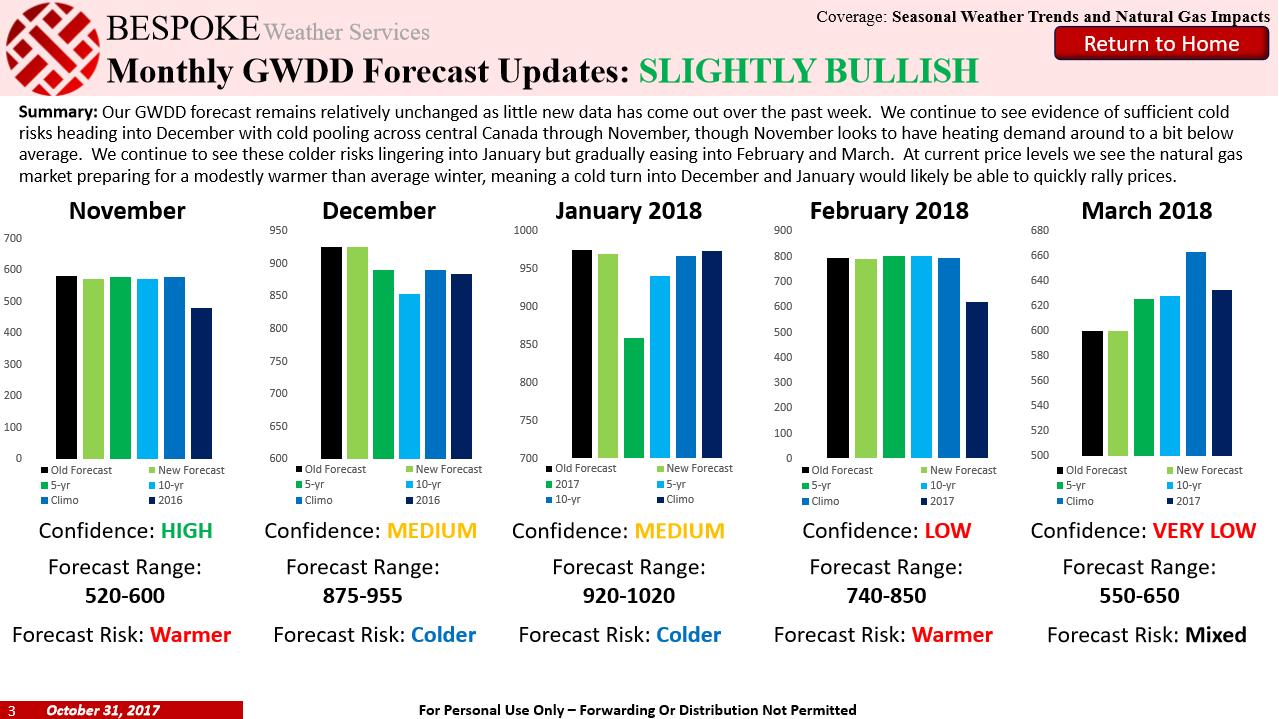

Early on in the winter we had been expecting heating demand expectations to be lower than average, with our October 31st Seasonal Trader Report calling for decently below average heating demand through the month.

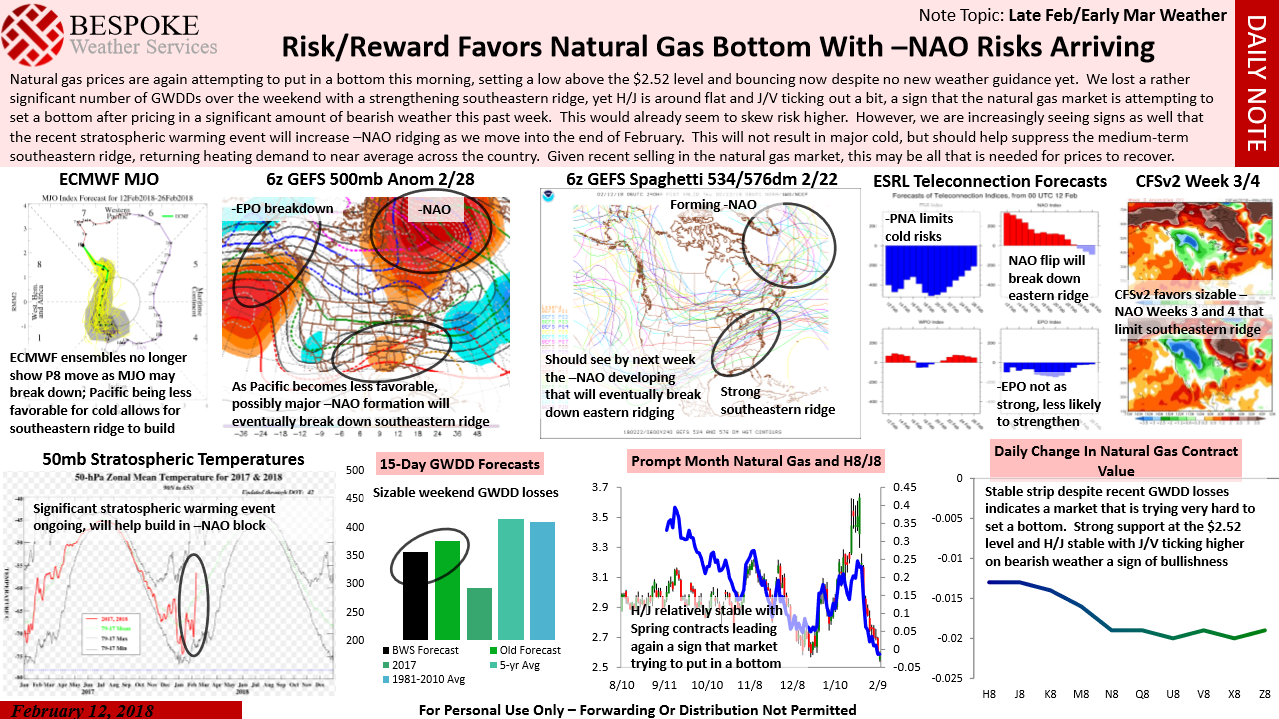

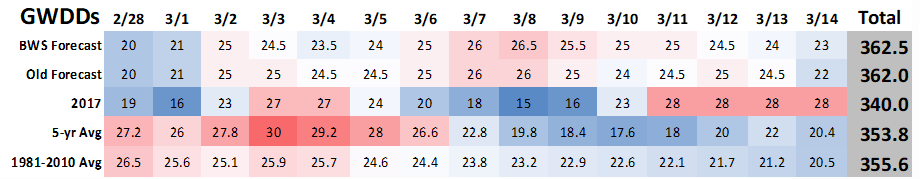

That changed as we began to see increasing cold risks increasing early in the month of March. Back on February 12th (when the April natural gas contract bottomed) we sent out a Note of the Day warning that a bottom was likely in as a -NAO atmospheric block would increase cold risks to end February.

Even our GWDD breakdown from our Morning Update this morning favored heating demand a bit above average through the next two weeks, in line with that CPC forecast.

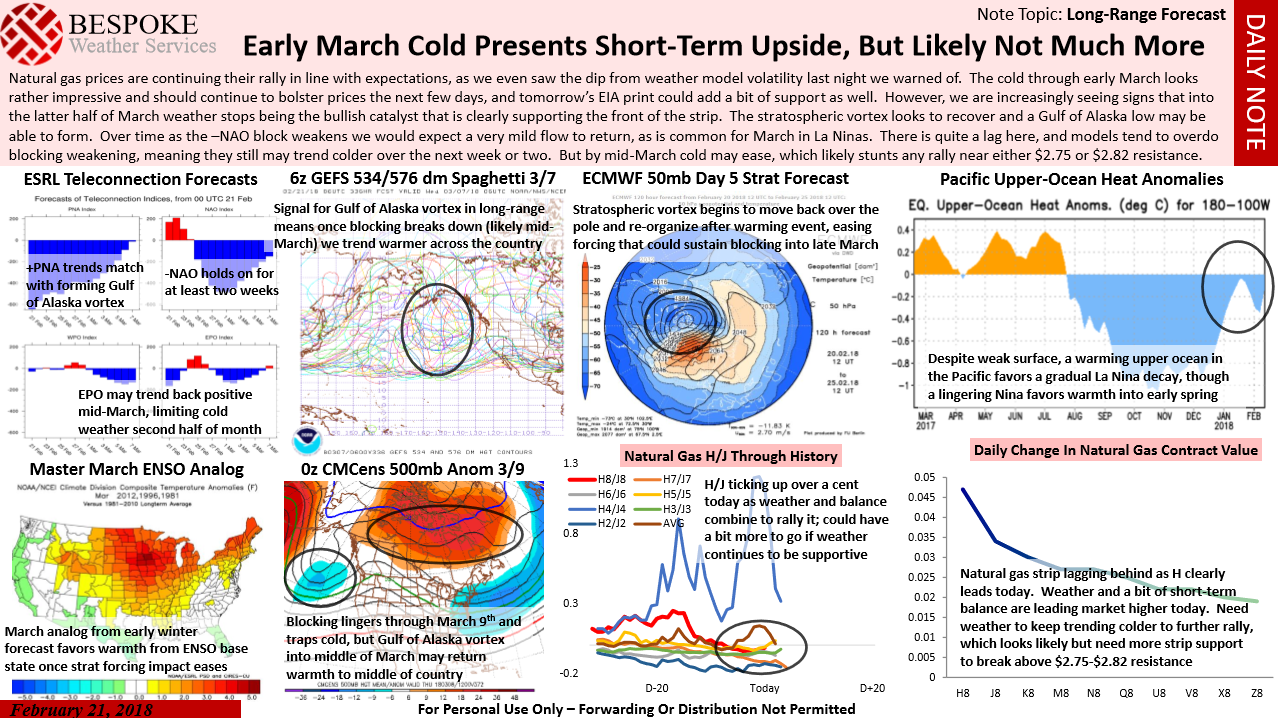

Yet as we outlined for clients last week, upside would be limited as the cold appeared unlikely to be particularly lasting.

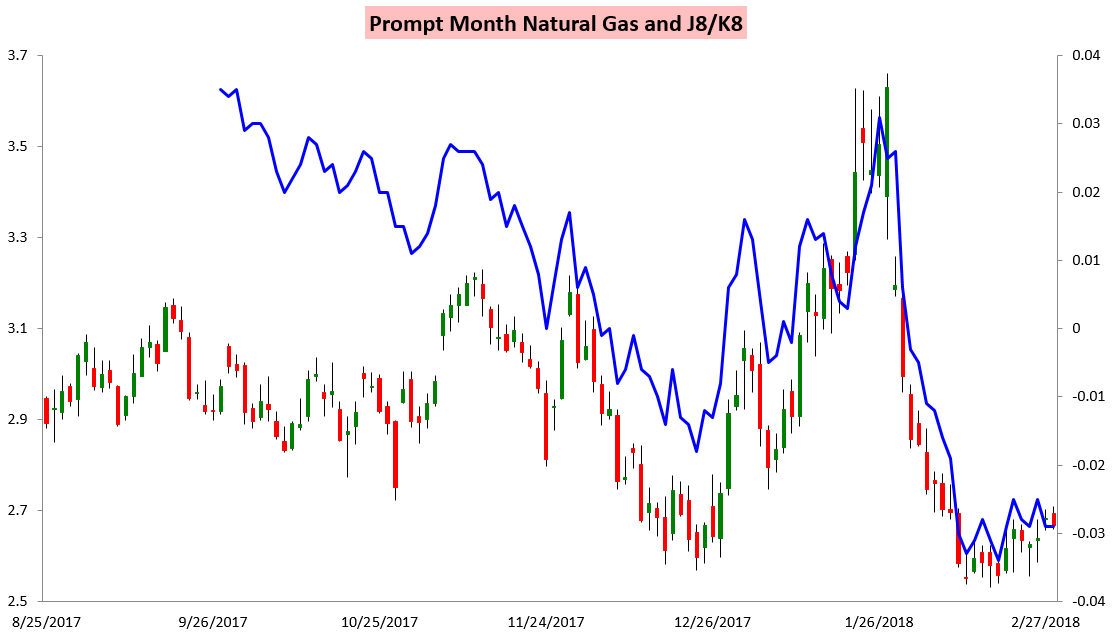

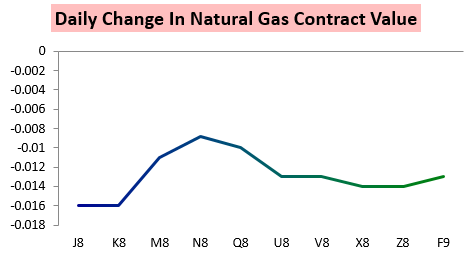

The result is that over the past week the April/May J8/K8 spread is actually down a tad, even as the prompt contract (and the April contract) have both remained firm.

The trend continued today, with smallest losses along the natural gas strip actually coming with the summer contracts.

Leave A Comment