Written by Gary

Premarkets were flat and generally quiet as the morning US financial’s came in green. Markets opened flat and fell fractionally and then sea-sawed around the unchanged line until the U of Michigan came in positive at 89.4 exceeding expectations of 87.5, then edged up into the green.

By 10 am the averages were trending up, albeit slowly and on low volume. The Markets look tired and ‘seem’ to be rounding off the new highs.

The US financial reporting was good this morning, but the markets were VERY slow in reacting positively. The move up was fractional and didn’t last.

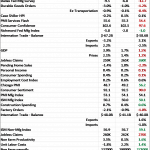

The first column is what was reported this morning. The second column is what was expected and the third is the last report.

Our medium term indicators are leaning towards sell portfolio of non-performersat the opening and the short-term market direction meter is bullish. We remain mostly conservatively bullish, neutral in other words. Right now now I am getting very concerned any downtrend could get very aggressive in the short-term and volatility may also promote sudden reversals. The SP500 MACD has turned flat, but remains above zero at 24.90. I would advise caution in taking any position during this uncertain period and I hope you have returned your ‘dogs’ to the pound.

Having some cash on hand now is not a bad strategy as market changes are happening everyday. As of now, I do not see any leading indicators that are warning of a ‘long-term’ reversal in the near-term. There may be one later in 2015, but any market fluctuations we see now are more of a internal market rectification than a bear market.

Investing.com members’ sentiments are 64 % Bearish (falling from 70% and now rising from 33%).

Investors Intelligence sets the breath at 52.8 % bullish with the status at BearCorrection. (Chart Here ) I expect a market reversal at or before ~25.0 should the direction continue to descend.

Leave A Comment