My Swing Trading Approach

Looking to increase my stop-loss on my profitable positions today, while adding 1-2 new long positions.

Indicators

VIX – Continues to decay off of those highs reached last Wednesday. Dropped 6.8% down to 10.65. I expect we’ll see sub-10 again very soon.

T2108 (% of stocks trading below their 40-day moving average): Day 3 of the bounce – up 4% to 50%. Big move overall in the last three days.

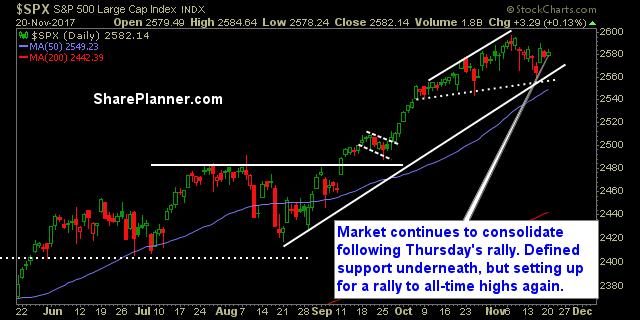

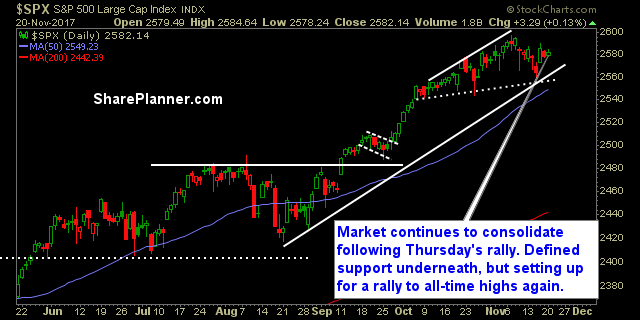

Moving averages (SPX): Same as the previous trading day – holding the 20-day, and wedged right between the 5-day and 10-day moving averages. The 5-day MA also crossed below the 20-day.

Industries to Watch Today

Technology hitting new highs and leading the market again. Industrials are bouncing. Consumer Cyclical continues to storm higher. Healthcare, Utilities, and Energy continue to struggle right now.

My Market Sentiment

The traditionally bullish week during the Thanksgiving Holiday, looks to stick to tradition. Key is whether the market can hold the gap and stick the new all-time highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment