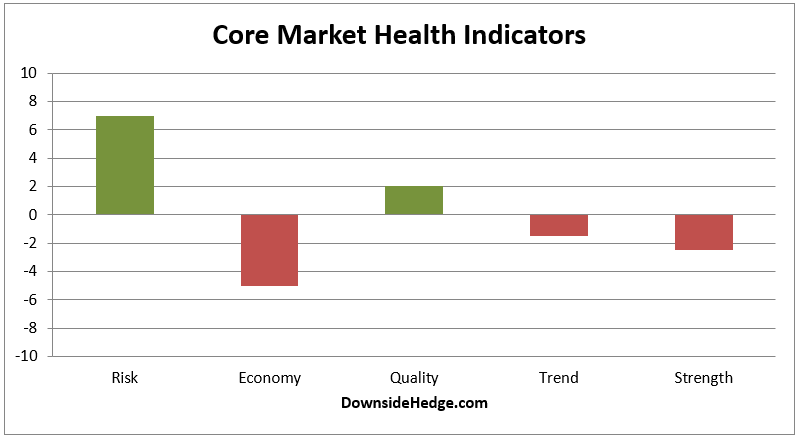

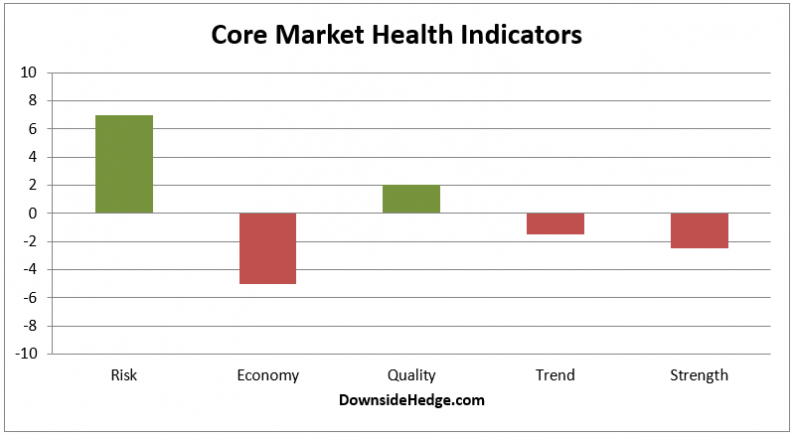

My core measures of market quality have gone positive again. My measures of market trend and strength are lagging. As I mentioned a few weeks ago, this suggests a somewhat choppy market ahead (although I was completely wrong on the chop keeping us from new highs in the S&P 500 Index — so maybe the consolidation will happen just above new highs). With market quality going positive the portfolio allocations change as noted below. As always, use your own personal risk tolerance to structure your own portfolio.

Volatility Hedged portfolio: 100% long (since 5/7/2018)

Long / Cash portfolio: 40% long and 60% cash

Long / Short Hedged portfolio: 70% long high beta stocks and 30% short the S&P 500 Index (or use an ETF like SH)

Leave A Comment