Yellin is yellin’ & the markets are listenin’

If you like volatility, you had to love this past week. After sliding 22 points on Tuesday, the market rebounded sharply on Wednesday, gave up those plus more on Thursday, and and struggled to stay positive on Friday.

The spike on Wednesday followed the release of the FOMC minutes which confirmed “bad news is still good news”for the markets as global weakness is keeping the Fed from hiking rates. The surge out of the gate on Friday was again “Fed Speak” as Fed President William Dudley continued “dovish” comments suggesting no rush to hiking rates anytime soon. To wit:

“Caution is needed because of our limited ability to reduce the policy rate to respond to adverse developments, recognizing that we could also use forward guidance and balance sheet policies to provide additional accommodation if that proved warranted.

Although the downside risks have diminished since earlier in the year, I still judge the balance of risks to my inflation and growth outlooks to be tilted slightly to the downside.“

And with those “silky smooth” words, traders rushed to buy stocks as the risk of tighter monetary policy continues to pushed further out into the future. Like the cartoon shows, courtesy of Hedgeye, the only thing that matters to the markets right now is the Fed.

Of course, while the Fed continues to talk about the need to hike rates in the future as inflationary pressures rise due to strong economic growth. A quick look at the Atlanta Fed’s GDPNow shows a bit of different story.

“The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2016 is 0.1 percent on April 8, down from 0.4 percent on April 5. After this morning’s wholesale trade report from the U.S. Bureau of the Census, the forecast for the contribution of inventory investment to first-quarter real GDP growth fell from –0.4 percentage points to –0.7 percentage points.”

It is worth noting on February 14th, the estimate for Q1 economic growth was ringing in at 2.7%. With earnings deteriorating and economic growth collapsing the ability for the Fed to raise rates remains a proverbial “Unicorn.”

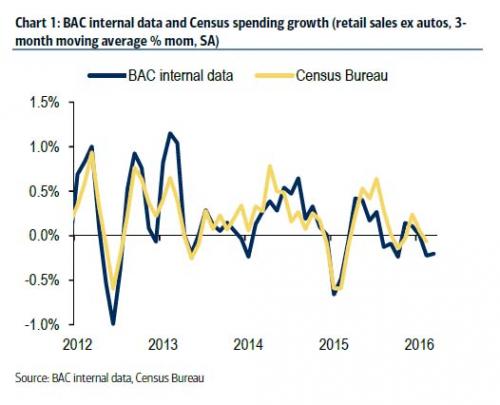

Of course, with consumer spending slowing sharply it is no wonder corporate profits, a direct reflection of real consumption, are getting weaker. The chart below, from Bank of America, shows the seasonally adjusted retail sales ex-autos measure from the BAC aggregate card data was unchanged SA in March, leaving the 3-month moving average to decline 0.2%. While a part of this weakness owes to a continued decline in gasoline prices. We find that retail sales ex-autos and gasoline was up 0.3% mom SA, which continues to be in a downward trend.

This confirms the downward revision to the Census Bureau data in January which made government data more consistent with the BAC internal data. According to Bank of America:

“We therefore also look for only a slight improvement in March Census Bureau sales, in a similar pattern as the BAC internal data.“

In other words, Q1 GDP is weak for a very specific reason: consumer spending remains anemic.

But wait, low oil and gasoline prices were supposed to provide a boost to consumers wallets?

That was always a grossly flawed and incorrect economic theory. As I explained in detail in “Falling Energy Costs & The Economic Impact:”

“Simply put, lower oil and gasoline prices may have a bigger detraction on the economy that the ‘savings’ provided to consumers.”

Earnings Season Begins, But May Be Disappointing

As we head into earnings season, estimates have been lowered, beaten down, crushed and lowered some more. So, when you lower the bar far enough, you shouldn’t be surprised to see a large number of companies, after share buybacks, accounting gimmicks, and cost cutting winning the “beat the estimate” game.

You can see the negative revisions in Dr. Ed Yardeni’s chart below.

But it is actually much worse than that. I keep track of the changes in S&P 500 estimates and reality and update a report at the end of each quarter. (See Latest Here)

The chart below from Goldman Sachs (GS), from November of 2014, expected corporate profits to surge in the coming years with 2015 ending at $122/share. As long as earnings keep accelerating higher, a P/E multiple of 17x earnings can be maintained indefinitely into the future.

Clearly, one should buy stocks today and hold them long-term given such an incredible undervaluation, right?

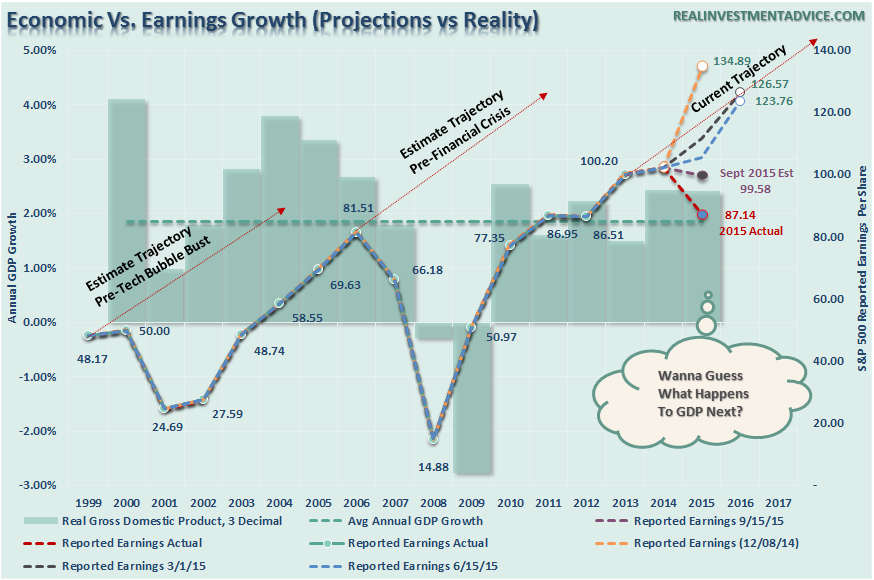

The problem is the is the huge disparity between expectations and reality as shown in the chart below which compares economic growth to earnings growth. Wall Street has always extrapolated earnings growth indefinitely into the future without taking into account the effects of the normal economic and business cycles. This was the same in 2000 and 2007. Unfortunately, the economy neither forgets nor forgives.

With estimates once again very optimistic, and given a complete disregard to the late stage of the current economic cycle, there is currently not one Wall Street analyst expecting a recession.

Unfortunately, it is only a function of time until the next economic downturn takes hold, particularly given the currently weak global outlook. As shown, earnings tend to cycle regularly between 6% peak to peak and 5% trough to trough growth in earnings. In 2014, expectations exceeded the current 6% peak to peak growth rate. I said then that it was only a question of what will trip up such overly optimistic picture. We now have that answer and real earnings have fallen far short of those original estimates.

The problem with forward earnings estimates is that they consistently overestimate reality by roughly 33% historically. The chart below shows the consistently sliding revisions of analyst expectations versus the reality of corporate profitability. At the end of 2014, it was estimated that by Q4 of 2015 reported earnings would reach in excess of $131.00. However, Standard & Poors then revised down their estimates to just $104.03 at the end of Q1 in 2015. We are now looking at just $86.53 a share for 2015. What a miss.

Leave A Comment