My Swing Trading Approach

I’m still cautious towards this market while it still works off overbought conditions. More sideways trading could be in the cards, and I don’t want to overload my portfolio with long positions.

Indicators

VIX – This indicator has rallied five out of the last six trading sessions. Now at 11.50, and the highest close since 9/8/17.

T2108 (% of stocks trading below their 40-day moving average): Fell to 47%, but another down-day making it FIVE straight and 18 of the last 21 days.

Moving averages (SPX): SPX held the 20-day moving average and bounced.

Industries to Watch Today

Consumer Defensive and Utilities lead the way – not ideal. Technology still remains my industry of choice. Industrials and Energy I am staying away from. Financials may be finally ready to bounce.

My Market Sentiment

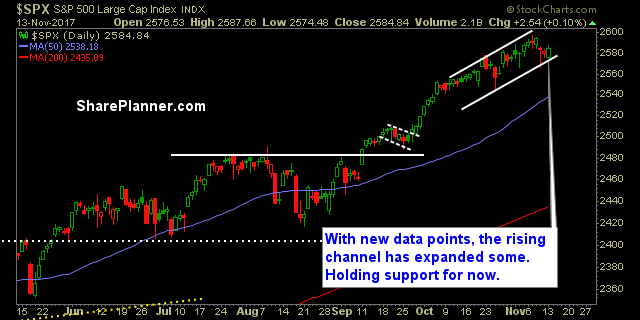

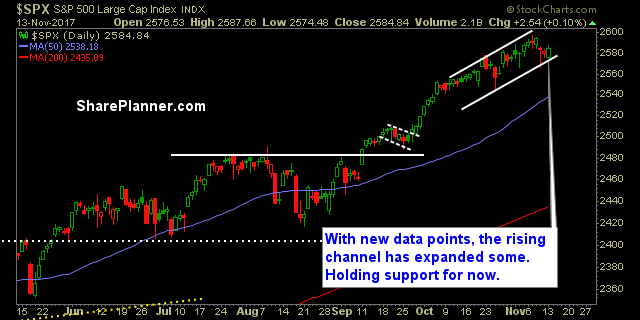

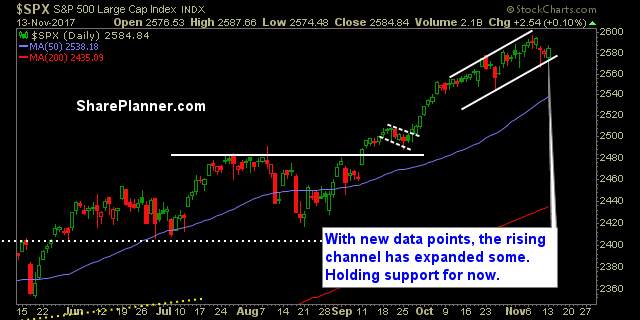

Bullish engulfing candle pattern yesterday, and a bounce off of the 20-day moving average inside of a rising channel, keeps this market bullish.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

5 long positions

Recent Stock Trade Notables:

Square (SQ): Long at $36.00, sold at $37.35 for a 3.8% profit.

Adobe (ADBE) : Long at $175.20, sold at $179.62 for a 2.5% profit.

Alibaba (BABA): Long at $187.00, sold at 181.77 for a 2.8% loss.

Paypal (PYPL): Long at $71.94, sold at $72.98 for a 1.5% profit.

Lam Research (LRCX): Long at 210.41, sold at $205.20 for a 2.4% loss.

Baidu (BIDU): Long at $242.80; sold at 248.29 for a 1% profit.

Nvida (NVDA): Long at $195.17, sold at $204.88 for a 5% profit.

Humana (HUM): Long at $248.73, sold at $261.20 for a 5% profit.

Square (SQ): Long at $32.92, sold at $34.36 for a 4.4% profit.

Nvida (NVDA): Long at $198.17, sold at $194.06 for a 2% loss.

Lennar Homes (LEN): Long at $56.63, sold at $58.10 for a 2.6% profit.

Lam Research (LRCX): Long at $185.23, sold at $192.24 for a 3.8% profit.

Starbucks (SBUX): Long at $55.59, sold at $54.94 for a 1.1% loss.

Illinois Tool Works (ITW): Long at $148.63, sold at $151.23 for a 1.8% profit.

Nvdia (NVDA): Long at $180.18, sold at $187.38 for a 4% profit.

Olin Corp (OLN): Long at $34.37, sold at $36.14 for a 5.2% profit.

Lowe’s (LOW): Long at $77.97, sold at $81.52 for a 4.6% profit

IBB: Long at $330.91, sold at $338.25 for a 2.2% profit.

Seagate Technologies (STX): Long at $34.35, sold at $33.89 for a 1.3% loss.

Wynn Resorts (WYNN): Long at $149.65, sold at $147.14 for a 1.7% loss.

Imax Corp (IMAX): Long at $23.03, sold at 22.26 for a 3.3% loss.

Marriott International (MAR): Long at $106.26, sold at $108.26 for a 1.9% profit.

Alibaba Group (BABA): Long at $170.63, sold at $170.29 for a 5.0% profit.

Workday (WDAY): Long at $106.91, sold at $104.90 for a 1.8% loss.

Nvdia (NVDA): Long at $170.45, sold at $187.94 for a 10.3% profit.

Leave A Comment