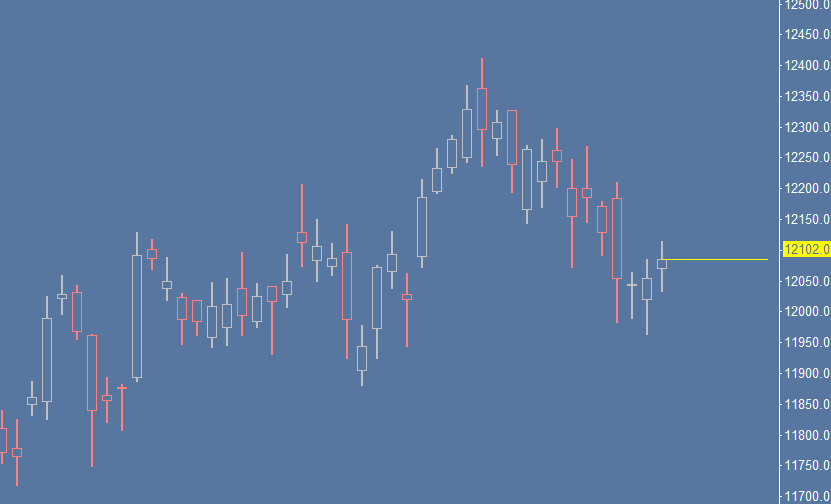

Besides of the Bund observations I want to share some notes on FDAX as well. The weekly perspective is somewhat one-time framing lower and the daily seem to have found some support after the inside day on Wednesday. Maybe we will see some gap open as EUR/USD (actually, only saw it on USD/JPY and thought to look up the EUR, too) opened with a huge gap up. I will observe the development of this.

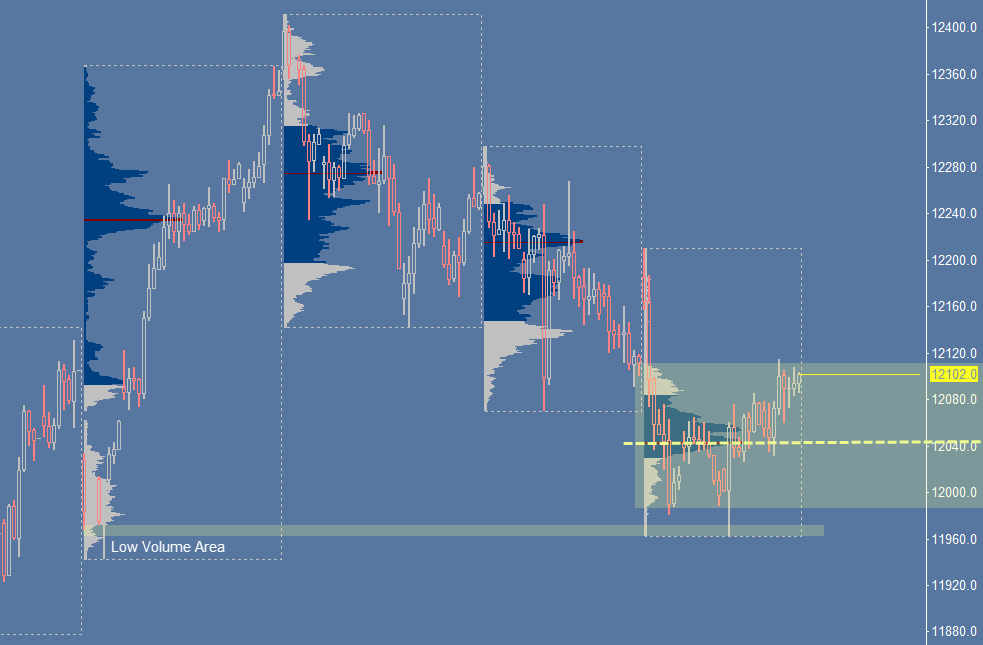

Moving forward to the volume profiles I would like to point out a low volume area which was supportive for the week (please see figure). The weekly profile shape is kind of balanced. Let’s see where the market will open and go with that. Open above distribution bullish and open below should be bearish. An open inside and I will lean on the extreme of the distribution curve. The VPOC should be a level of interest, too.

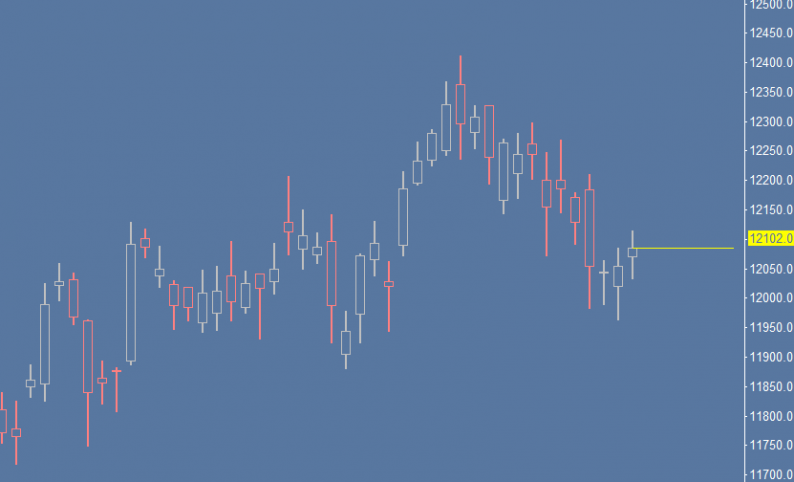

On Friday the market found support at Thursday’s P shaped profile’s VPOC as the market opened above it. The market left the week with a balanced profile. Again, open inside of value leans on the extremes. Open above or below, go with the imbalance. It’s really tricky. I will wait for the open and update my game plan accordingly.

Leave A Comment