Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations on investment returns. In a “normal” market environment — one with conventional business cycles, Federal Reserve policy, interest rates and inflation — current valuation levels would be a serious concern.

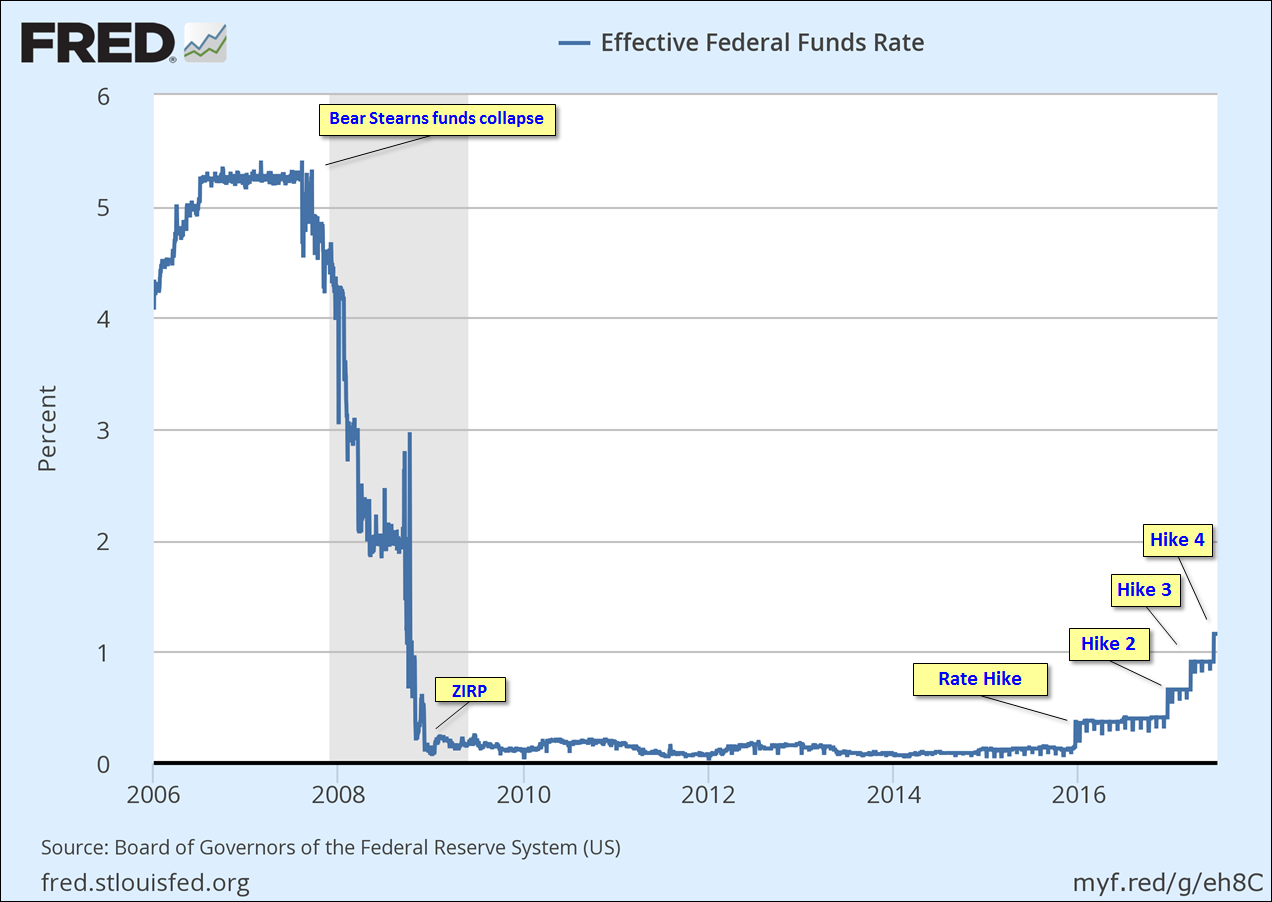

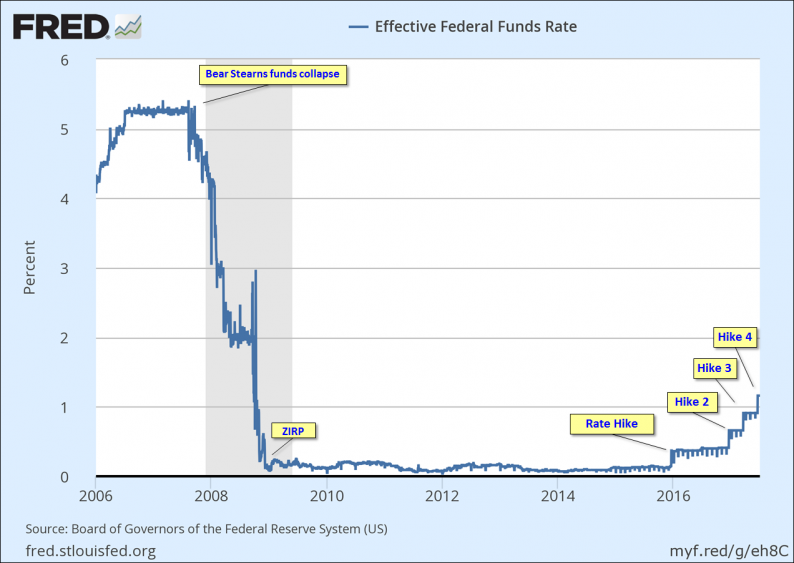

But these are different times. The economic cycle shaped by the Financial Crisis that began emerging in 2007 shortly after the Bear Stearns hedge fund collapsed. The Fed began its historic crusade in cutting the overnight rate from an average of 5.25% prior to the hedge fund collapse to ZIRP (Zero Interest Rate Policy) as of December 16, 2008. The bankruptcy of Lehman Brothers on September 15, 2008 was the most dramatic precipitator of the Fed’s unprecedented policies.

In the wake of the Financial Crisis, inflation has been low and the 10-year Treasury yield is about 74 basis points above its historic closing low of 1.37% in early July of 2016. So, with this refresher on the Financial Crisis in mind, let’s take another look at the popular P/E10 valuation metric.

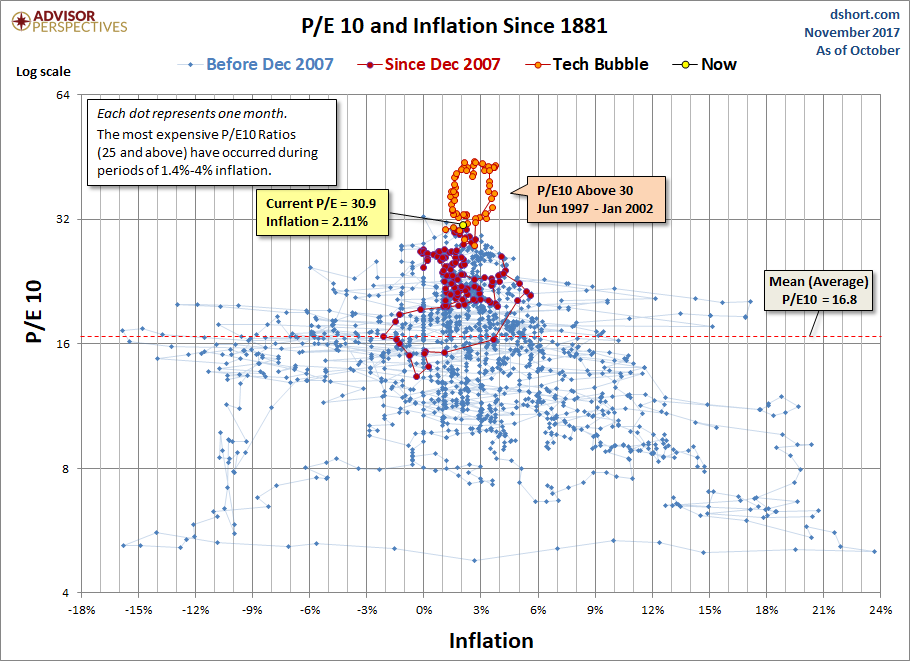

Here is a scatter graph with the market valuation on the vertical axis (log scale) and inflation on the horizontal axis. It includes some key highlights: 1) the extreme overvaluation and irrational period of the Tech Bubble, 2) the valuations since the start of last recession, 3) the average P/E10 and 4) where we are today.

The inflation “sweet spot”, the range that has supported the highest valuations, is approximately between 1.4% and 3%. See, for example, the highlighted extreme valuations associated with the Tech Bubble arbitrarily as a P/E10 of 25 or so and higher. The chronology of the orange “bubble” on the chart is a clockwise loop of 56 months starting at the 6 o’clock position. The P/E10 was 31.3 and the annual inflation rate for that month, June 1997, was 2.30%. The average inflation rate for the loop was 2.41%. The P/E10 peak of 44.2 in December 1999 was accompanied by a 2.68% annual inflation rate. Two months later the inflation rate topped 3% at 3.22%. The right side of the loop shows what happened thereafter. The ratio slipped below 30 for two months (the tail at the bottom of the loop) before its final three-month swan song in the 30+ range. Even periods with a P/E10 of over 25 are still considered high.

Leave A Comment