The overnight news was decidedly downcast, with first London mayor Boris Johnson voicing his support for Brexit leading to a collapse in the pound, validating our Saturday warning and then some, resulting in the biggest drop in cable in over a year over fears that the EU will lose one of its most critical members…

… then followed by a surprising loss, the first in 5 years, by HSBC – the bank that makes money laundering for criminals around the globe a breeze – as revenue dropped and loans to oil and gas companies drove a jump in impairment charges, leading to a 5% drop in its share price, but more concerning is that HSBC said bad loan impairments and provisions soared 32% to $1.62BN driven by the oil and gas sector. In other words banks are concealing far more energy losses on their books than they have so far admitted.

Finally, we got yet another indication that the global slowdown is spreading to Europe, when first French composite PMI printed at 49.8 missing expectations, then Germany’s PMI likewise missed at 50.2, which meant that the Markit composite Purchasing Managers Index for the euro zone fell to 52.7, the lowest since January 2015, from 53.6. In Germany, manufacturing took a hit from falling overseas demand, while the composite gauge for France signaled “sluggish” economic growth.

From the Markit Report:

The flash Markit Eurozone PMI fell from 53.6 in January to 52.7, the lowest since January of last year. The second consecutive monthly slowing in the rate of output expansion reflected a waning in growth of new orders for a third successive month, resulting in the smallest rise in new business for 12 months.

Backlogs of work were broadly unchanged as a result of the weaker increase in new work. With outstanding business stagnant, firms limited their hiring of new staff, leading to the weakest net increase in employment for five months.

Manufacturing output showed the smallest increase since December 2014, moving closer to stagnation amid a further faltering in growth of new orders and exports.Services fared better, though nevertheless saw growth weaken to the slowest since January of last year. Moreover, a sharp deterioration in optimism about future activity growth in the services sector points to further weakness in coming months

It wasn’t just Europe: in China the MNI business indicator for February declined 2.4 pts to 49.9, matching the level seen in November in the process. Meanwhile in Japan and kicking off a busy day for PMI’s the flash February manufacturing print tumbled 2.1pts this month to a well below market 50.2 (vs. 52.0 expected) which was the lowest since June.

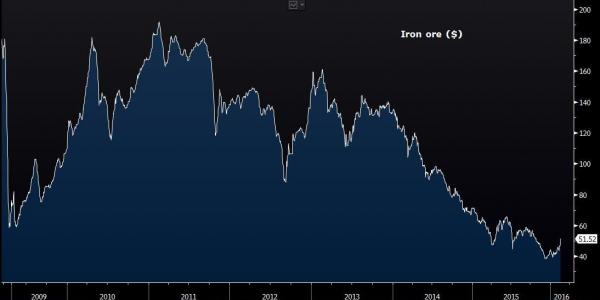

And yet, despite – or rather thanks to – this slew of negative news, global markets and US equity futures soared from the moments Japan opened (driven by the traditional BOJ-inspired spike in the USDJPY), and never looked back – in the process even breaking Europe’s futures exchange Eurex, as traders focused on the record surge in Chinese loan creation, which as we reported last week will have hit $1 trillion in the first two months of 2016, which in turn pushed commodities and especially iron ore higher by 6.2%, back over $50, or $51.52 a dry ton specifically, the highest level since Oct. 27. The commodity has jumped 18 percent this year after plunging to $38.30 in December, the lowest in more than six years; the reason: Chinese corporations are taking advantage of the debt glut and doing what got them in trouble in the first place: stockpiling.

Helping lift the risk mood was the PBoC which provided CNY 169BN of funds under its Medium-term Lending Facility and the Finance Ministry announced a reduction of home transaction taxes, pushing the Shanghai Comp higher by 2.4%, the highest level in one month.

So propped up by the Chinese central bank and by a debt-spewing Chinese finance ministry, with further hopes a backsliding European economy will mean even more easing by Draghi, the risk on mood is back: “People are willing to take risk again,” Karl Goody, a private wealth manager at Shaw and Partners Ltd. in Sydney told Bloomberg. “People are looking at the selloff this year and saying: enough is enough, there’s been enough pain now.”

As a result of today’s commodity euphoria, the Stoxx 600 was led higher by miners and carmakers. BHP Billiton Ltd. and Rio Tinto Group jumped more than 5 percent, among the biggest gains in Britain’s FTSE 100 Index.Ironlcally, U.K. equities added 1.2 percent. The FTSE 100 this year is the best performer among major national measures in western Europe, helped by a weakening pound.

“While we still have some pretty big risks out there, the market has sold off so much it was about time we got a bounce back,” said Allan von Mehren, chief analyst at Danske Bank A/S in Copenhagen. “We’ve seen a turnaround in the commodities sector. Some of the drag from China is also starting to ease. We have a bit further to go in this relief rally”

Futures on the Standard & Poor’s 500 Index expiring in March rose 1.2 percent, indicating equities will extend gains after posting their strongest weekly advance since November. Allergan Plc is among four S&P 500 members posting earnings on Monday. What is curious is that over the weekend the latest twist in the US Presidential campaign saw Donald Trump secure victory in the South Carolina Republican primary, beating Rubio and Cruz into second and third place respectively.And while Trump’s steamrolling in the primaries has been said to be broadly negative for equities, so far US equity futures are up well over 1.0%.

Leave A Comment