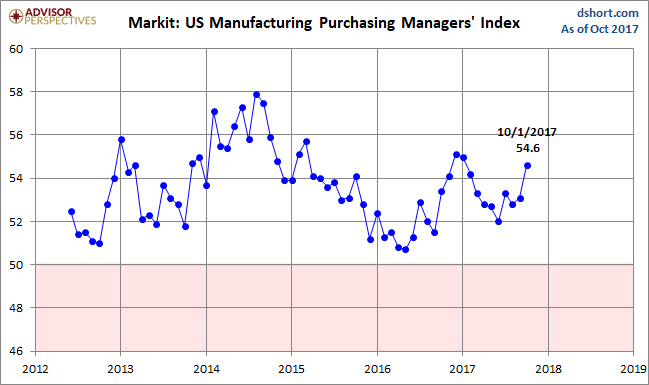

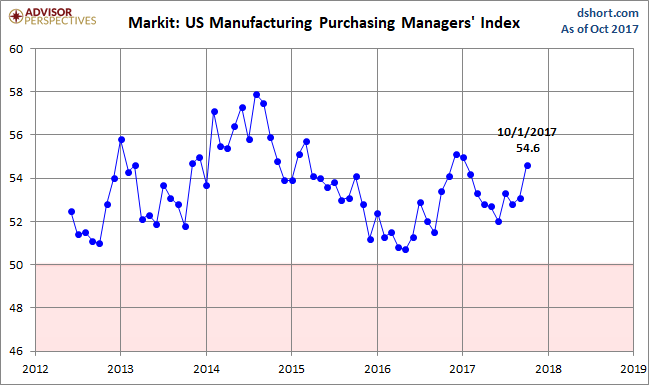

The October US Manufacturing Purchasing Managers’ Index conducted by Markit came in at 54.6, up from the 53.1 final September figure. Today’s headline number was above the Investing.com forecast of 54.5. Markit’s Manufacturing PMI is a diffusion index: A reading above 50 indicates expansion in the sector; below 50 indicates contraction.

Here is the opening from Chris Williamson, Chief Business Economist at IHS Markit in their latest press release:

“US manufacturing stepped up a gear at the start of the fourth quarter, boding well for higher factory production to support robust economic growth in the closing months of 2017.

“Production volumes jumped higher on the back of a substantial improvement in order book inflows, in part due to supply chains returning to normal after the hurricanes but also reflecting a combination of strong underlying demand.

“Factory jobs growth has also picked up to one of the strongest since the global financial crisis, underscoring the improvement in optimism about future trading among manufacturers.

“An important change in October was the broadening out of the expansion to smaller firms, which have lagged behind the strong growth reported by larger rivals throughout much of the year to date but under-performed to a lesser extent in October.” [Press Release]

Here is a snapshot of the series since mid-2012.

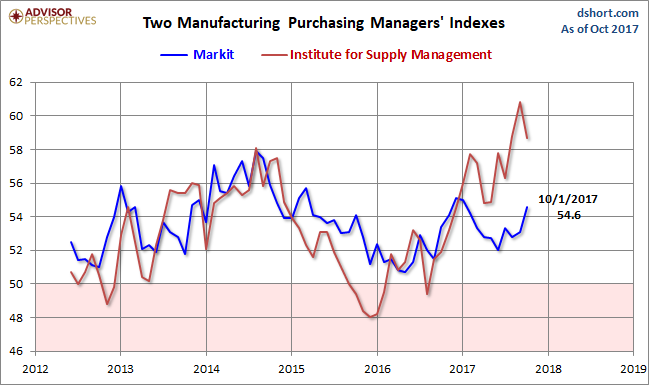

Here is an overlay with the equivalent PMI survey conducted by the Institute for Supply Management (see our full article on this series here, note that ).

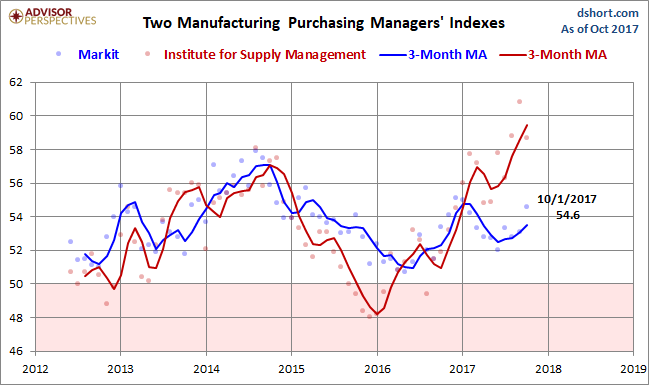

The next chart uses a three-month moving average of the two rather volatile series to facilitate our understanding of the current trend.

The two moving-average series diverged again in 2017. The ISM index expanded through most of 2016, and has continued this expansion despite a small decline in early 2017. The Markit series has trended more steadily downward from its interim high early in the second half of 2014.

Leave A Comment