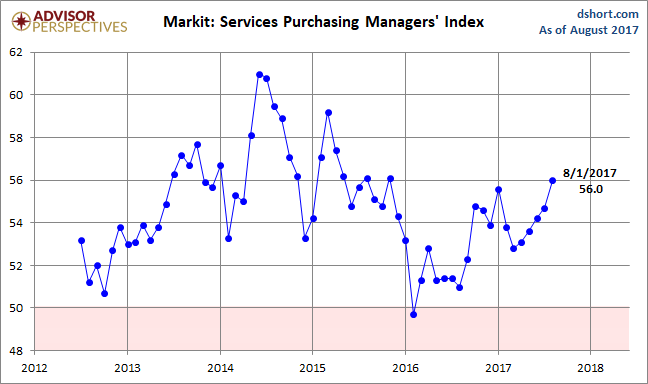

The August US Services Purchasing Managers’ Index conducted by Markit came in at 56.0 percent, up 1.3 percent from the July estimate. The Investing.com consensus was for 56.8 percent. Markit’s Services PMI is a diffusion index: A reading above 50 indicates expansion in the sector; below 50 indicates contraction.

Here is the opening from the latest press release:

August data signalled an accelerated upturn in business activity across the US service sector. New orders also expanded at a quicker rate, with growth reaching a 25-month high. Higher activity and new business prompted firms to add to their payrolls again in August, and at the quickest rate for nearly two years. On the prices front, both input costs and output charges increased again, with rates of inflation reaching 26- and 35-month highs, respectively. Meanwhile, business confidence was the strongest since January, with firms encouraged by greater client demand.

The seasonally adjusted IHS Markit U.S. Services Business Activity Index registered 56.0 in August, up from July’s reading of 54.7. The latest survey extended the current sequence of activity growth to 18 months. Moreover, the upturn was the fastest since November 2015, with a number of panellists stating that higher activity was underpinned by a greater willingness to spend among clients and improving market conditions.[Press Release]

Here is a snapshot of the series since mid-2012.

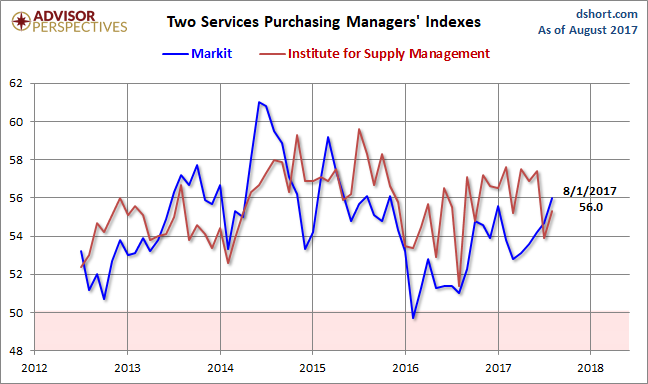

Here is an overlay with the equivalent PMI survey conducted by the Institute for Supply Management, which they refer to as “Non-Manufacturing” (see our full article on this series here). Over the past year, the ISM metric has been significantly the more volatile of the two.

The next chart uses a three-month moving average of the two rather volatile series to facilitate our understanding of the current trend. Since early in 2016, the ISM metric has shown stronger growth than the Markit counterpart. It will be interesting to see how these two indicators play out for the remainder of 2017.

Leave A Comment