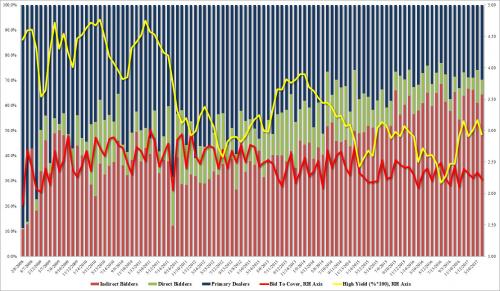

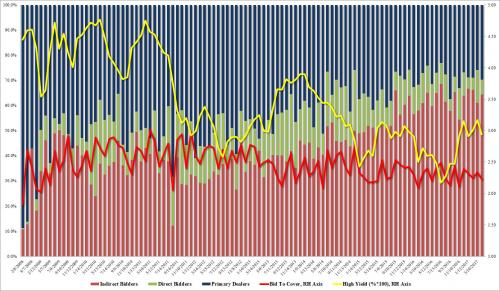

With the 30Y trading comfortably in repo today, with no tightness as indicated by the +0.7% repo rate, it seemed possible that the auction would join this week’s previous 2 auctions of 3 and 10 Year paper by printing with a modest tail. So when the Treasury announced results from today’s 29-Year 10-Month reopening, few were surprised that the High Yield of 2.938% tailed the When Issued of 2.929% by 0.9bps, suggesting yet another mediocre auction. 27.01% of the bids at the high yield were accepted.

The internals confirmed the poor result: the bid/cover was 2.23, down from 2.34 at last month’s auction and below the 2.31% 6 month average. This was the lowest bid to cover since November 2016.

Indirect bidders took down 64.5% of the auction, just above the 62.9% average, while Direct bidders took down 5.8% of the auction, a sharp drop from last month’s 13.1%, and below the 6 month average of 8.4%. Dealers were left with 29.7% of the allotment.

The conclusion of this week’s TSY issuance left quite a bit to be desired in terms of primary demand, and since the recurring tails suggest that many of the TSY shorts have been mostly closed out, it implies a growing possibility that a new layer of shorts will be put across the curve in the near future.

Leave A Comment