Image Source: Pixabay

Image Source: Pixabay

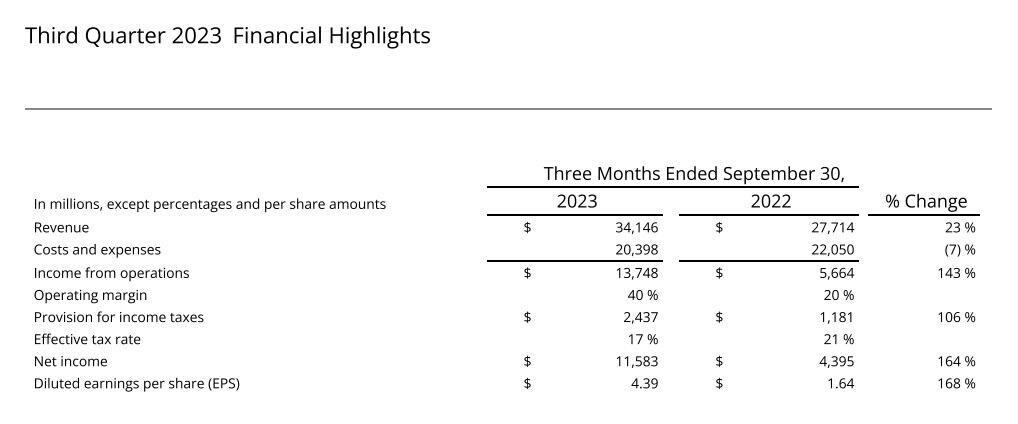

Following up on our preview of hedge-fund darling Meta’s Q3 earnings, we note that the last few months have been quite positive for the company: last quarter Meta rebounded from a digital ad slump, beating expectations and hitting double-digit revenue growth for the first time in 18 months. Expectations will be high after the company forecast revenue growth of as much as 20% for the quarter and after Snap and Alphabet both topped expectations for ad revenue.Meanwhile, as Bloomberg notes, Meta – like all gigatech peers – has been all in on AI since last quarter, introducing AI chatbots for Instagram, Facebook, and WhatsApp; launching new tools for marketers to create ads using AI; and releasing a free version of coding software similar to Microsoft GitHub. Meta is betting that AI-recommended content will help keep users on Facebook and Instagram. The company is especially focused on Reels, short-form videos that are similar to TikTok’s. I’ll be listening for how much time users spent on Reels videos and whether that translated into more ad dollars.Additionally, Bloomberg Intelligence analyst Mandeep Singh says Meta’s continuation of high-teens growth for 3Q and into 2024 may hinge on a sharp positive inflection in ad pricing, which has been declining the past six quarters: “Though the company’s Reels momentum has aided above-consensus impressions growth across its Instagram and Blue apps, we think ad loads and engagement growth are likely to plateau in the near term,” Singh said in a recent note. On the other end, Reality Labs segment losses for 2024 will be a primary focus, given the company’s recent launch of Quest 3 and Ray-Ban AR glasses.And so, as we get the numbers of Q3, here is a snapshot of where we stand: Meta shares fell 4.2% Wednesday, its worst daily performance since July; that said, the company is still up nearly 150% in 2023 although it is expected to be volatile: as noted earlier, the options market is signaling that Meta shares should move 8% in either direction, that’s less than the average 15% move over the past two years, suggesting that post-earnings volatility may be subdued this quarter.With all that in mind, moments ago Meta reported Q3 earnings which beat on the top and bottom line, and guided to Q4 revenues whose midline is right on top of the consensus estimate:

- Advertising rev. $33.64 billion, +24% y/y, beating estimates $32.94 billion

- Family of Apps revenue $33.94 billion, +24% y/y, beating estimates $33.08 billion

- Reality Labs revenue $210 million, -26% y/y, missing estimates $313.4 million

- Other revenue $293 million, +53% y/y, beating estimates $212.7 million

- Average price per ad -6% vs. -18% y/y, beating estimates -8.94%

Some more details on the company’s ad business:

Some more details on the company’s ad business:

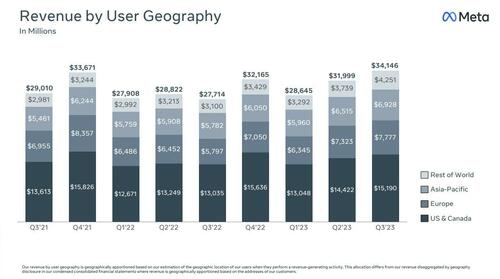

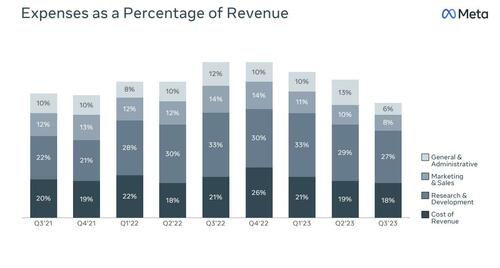

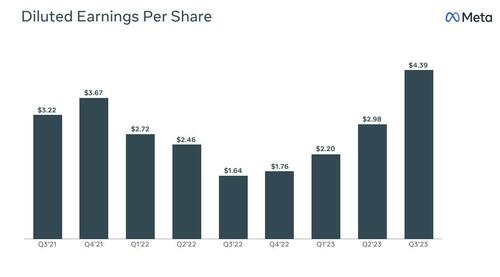

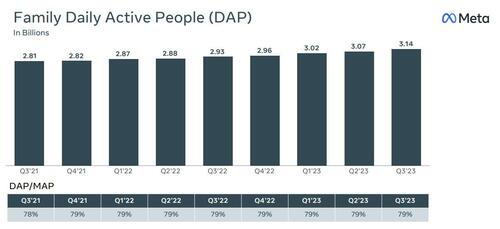

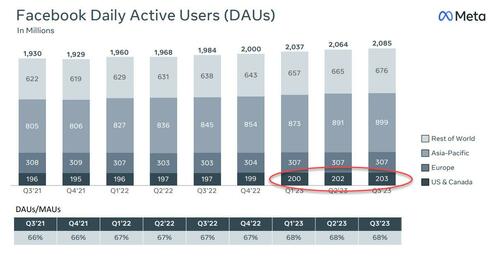

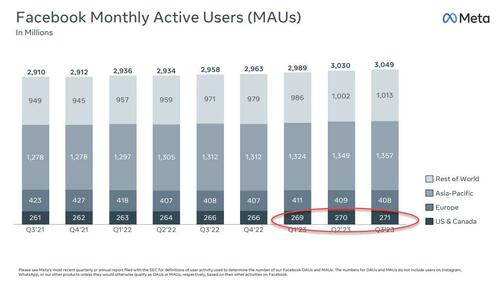

Some key charts:

And the funniest chart of all: according to FB, 203 million Americans and Canadians are on Facebook daily.

And the funniest chart of all: according to FB, 203 million Americans and Canadians are on Facebook daily. And the punchline: 75% of Americans and Canadians are on Facebook every month. Sure they are.

And the punchline: 75% of Americans and Canadians are on Facebook every month. Sure they are. Looking ahead, the company forecast Q4 revenue in the range of $36.5-40 billion, whose midline is smack on top of the Wall Street consensus of $38.76BN. The guidance assumes currency tailwind of approximately 2% to year-over-year total revenue growth in the fourth quarter, based on current exchange ratesAlso from its guidance, Facebook slashed its total expenses by $2 billion for the full year 2023, which it now sees in the range of $87-89 billion, lowered from the prior range of $88-91 billion. This outlook includes approximately $3.5 billion of restructuring costs related to facilities consolidation charges and severance and other personnel costs. The company also expects Reality Labs operating losses to increase year-over-year in 2023.And in a move which AI peers like NVDA and ANET are hardly excited about, Meta also trimmed its CapEx guidance, which it now expects to be in the range of $27-29 billion, updated from the prior estimate of $27-30 billion. Which means less spending on AI chips and chatGPT algos. In kneejerk response, both NVidia and Arista slumped on the capex guidance cut, although that may be premature since META noted that CapEx growth will be “driven by investments in servers, including both non-articial intelligence (AI) and AI hardware, and data centers as we ramp up construction on sites with the new data center architecture we announced late last year.”In the earnings release, Chief Executive Officer Mark Zuckerberg called out the company’s work in AI and its new virtual reality headset, the Quest 3, and Ray-Ban smart glasses.Meanwhile, two years after its ridiculous rebranding, Meta still plans to lose money in Reality Labs, the division that builds metaverse tech: “we expect operating losses to increase meaningfully year-over-year due to our ongoing product development eorts in augmented reality/virtual reality and our investments to further scale our ecosystem”Bloomberg Intel’s Mandeep Singh tells Bloomberg TV that the flagship Blue app is almost half of revenue, and “that revenue is sort of flat. Instagram is the growing portion.”“They have spent $50 billion on Reality Labs. We still don’t have a product that is margin-accretive. they are losing money on every headset they are selling. We don’t know what ecosystem they can create.”In kneejerk response META stock jumped as much as 3% but has since eased back erasing much of its after-hour gains, and ensuring that anyone who expected an outsized move using options is about to see a total loss.

Looking ahead, the company forecast Q4 revenue in the range of $36.5-40 billion, whose midline is smack on top of the Wall Street consensus of $38.76BN. The guidance assumes currency tailwind of approximately 2% to year-over-year total revenue growth in the fourth quarter, based on current exchange ratesAlso from its guidance, Facebook slashed its total expenses by $2 billion for the full year 2023, which it now sees in the range of $87-89 billion, lowered from the prior range of $88-91 billion. This outlook includes approximately $3.5 billion of restructuring costs related to facilities consolidation charges and severance and other personnel costs. The company also expects Reality Labs operating losses to increase year-over-year in 2023.And in a move which AI peers like NVDA and ANET are hardly excited about, Meta also trimmed its CapEx guidance, which it now expects to be in the range of $27-29 billion, updated from the prior estimate of $27-30 billion. Which means less spending on AI chips and chatGPT algos. In kneejerk response, both NVidia and Arista slumped on the capex guidance cut, although that may be premature since META noted that CapEx growth will be “driven by investments in servers, including both non-articial intelligence (AI) and AI hardware, and data centers as we ramp up construction on sites with the new data center architecture we announced late last year.”In the earnings release, Chief Executive Officer Mark Zuckerberg called out the company’s work in AI and its new virtual reality headset, the Quest 3, and Ray-Ban smart glasses.Meanwhile, two years after its ridiculous rebranding, Meta still plans to lose money in Reality Labs, the division that builds metaverse tech: “we expect operating losses to increase meaningfully year-over-year due to our ongoing product development eorts in augmented reality/virtual reality and our investments to further scale our ecosystem”Bloomberg Intel’s Mandeep Singh tells Bloomberg TV that the flagship Blue app is almost half of revenue, and “that revenue is sort of flat. Instagram is the growing portion.”“They have spent $50 billion on Reality Labs. We still don’t have a product that is margin-accretive. they are losing money on every headset they are selling. We don’t know what ecosystem they can create.”In kneejerk response META stock jumped as much as 3% but has since eased back erasing much of its after-hour gains, and ensuring that anyone who expected an outsized move using options is about to see a total loss. Earnings presentation below:More By This Author:Yields Jump After Gruesome 5Y Auction Prices With Biggest Tail In 15 MonthsIRS Collects $160 Million From Wealthy Taxpayers Amid ‘Increased Compliance Efforts’Regional Fed Surveys Show Prices Jumping As Business Outlooks Slump

Earnings presentation below:More By This Author:Yields Jump After Gruesome 5Y Auction Prices With Biggest Tail In 15 MonthsIRS Collects $160 Million From Wealthy Taxpayers Amid ‘Increased Compliance Efforts’Regional Fed Surveys Show Prices Jumping As Business Outlooks Slump

Leave A Comment