Metals and Miners are rallying instead of breaking down. The trend is a mess, attempting to trade these markets is dangerous. Gold needs to break the October high ($1,308.40) or the October low ($1,262.80) for direction. Otherwise, prices will remain in a challenging range.

Metals and Miners could set rebound highs this week. There is substantial resistance in gold between $1,292 and $1,300. I’ll watch the trend and update as needed.

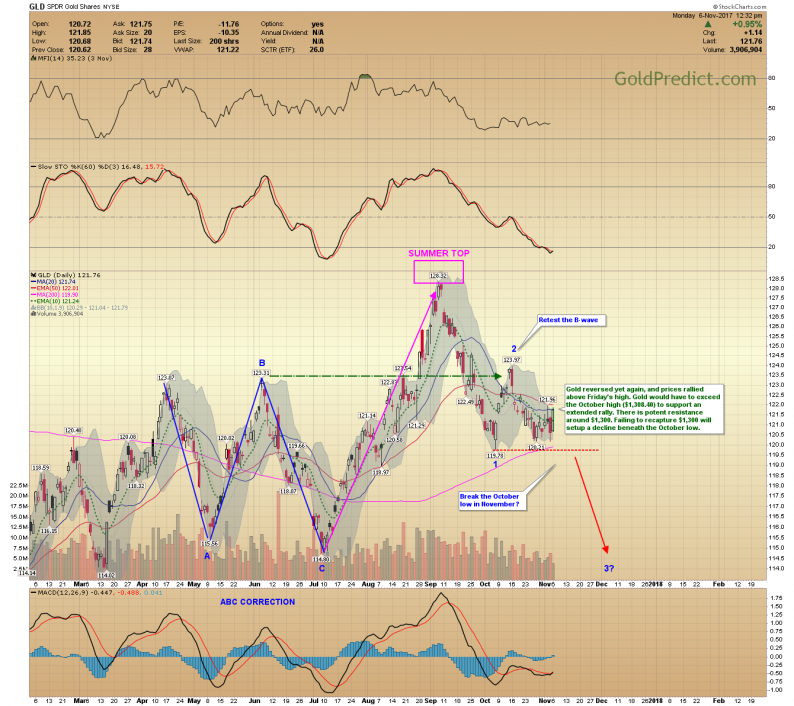

GLD- Gold reversed yet again, and prices rallied above Friday’s high. Gold would have to exceed the October high ($1,308.40) to support an extended rally. There is potent resistance around $1,300. Failing to recapture $1,300 will setup a decline beneath the October low.

GDX- The breakdown from the pennant pattern was short-lived. Miners reached a new rebound high. Prices were oversold, so I’m not too surprised. The rebound should end this week if this is just an interim bounce.

GDXJ- Juniors also made fresh rebound highs.

ERX- Prices exploded through resistance. I’ll watch the trend and consider selling the remainder of my position if prices begin to fade. $33.00 still seems achievable.

Leave A Comment