The third quarter of 2018 is nearly half over, which makes it a good time to see how the number of dividend cuts that have been announced over the previous six weeks compared with the same points of time in the third quarter of 2017 and also the previous two quarters of 2018!

Let’s start with the year-over-year comparison of the third quarters of 2017 and 2018 from our two near-real-time sources for these dividend declarations.

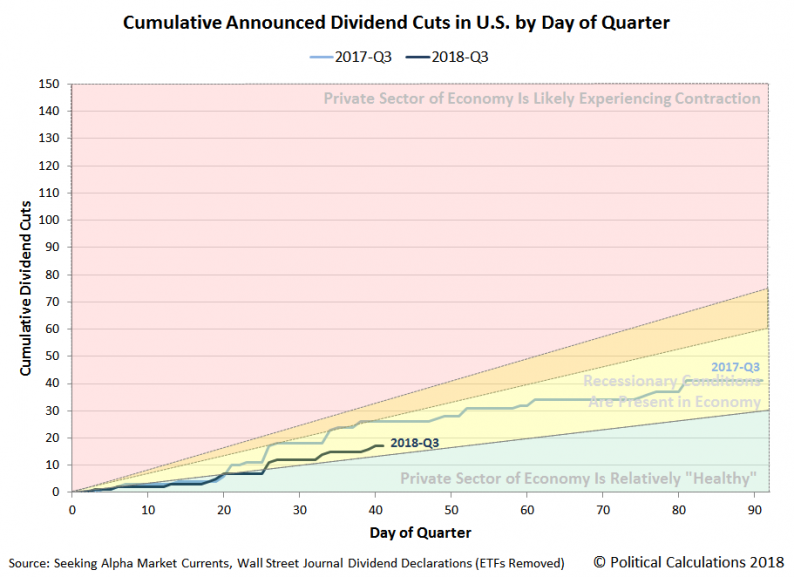

Compared to 2017-Q3, the pace of dividend cuts announced so far in the current quarter of 2018-Q3 is running well behind, which represents an improved situation for publicly traded companies in the U.S.

Likewise, when we compare 2018-Q3 against both 2018-Q1 and 2018-Q2, we find that dividend cut announcements in the third quarter of 2018 is so far keeping pace with what was recorded during the first quarter, but is slower than what we saw during the second quarter. Again, that’s good news.

Through Friday, 10 August 2018, we’ve recorded the following 17 dividend cut announcements for 2018-Q3.

Tallying up the 2018-Q3 list of dividend cuts to date, over half are firms (9) in the oil and gas industries, six are financial firms or Real Estate Investment Trusts (REITs), one (R.R. Donnelley & Sons) is a provider of business services and one last one (Pentair) may not really count as a true dividend cut, where the company recently span-off its electrical products division into a new dividend-paying company called nVent Electric (NYSE: NVT).

Leave A Comment