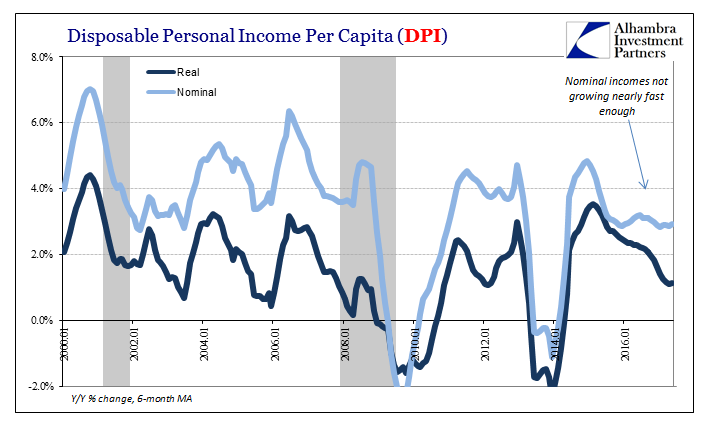

With inflation tailing off as oil price base effects fade, statistics that turn nominal into real terms will start looking better. Real Disposable Personal Income per Capita, for example, increased in May 2017 at a faster rate than in January. The difference, however, isn’t all that much. The CPI in January was 2.50% and 1.87% in May, but Real DPI per Capita accelerated only from +0.86% year-over-year the to +1.49% now, a perfect 63 bps equalization (it doesn’t quite work out that way in nominal terms, but close enough).

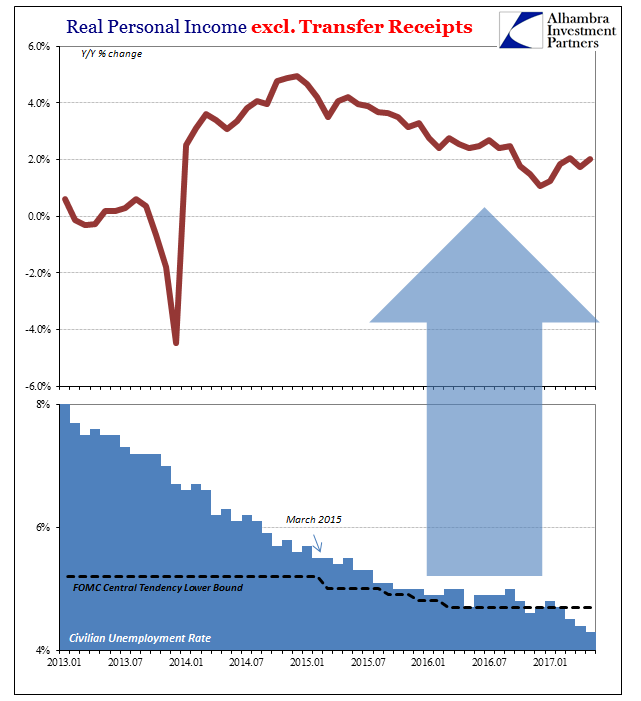

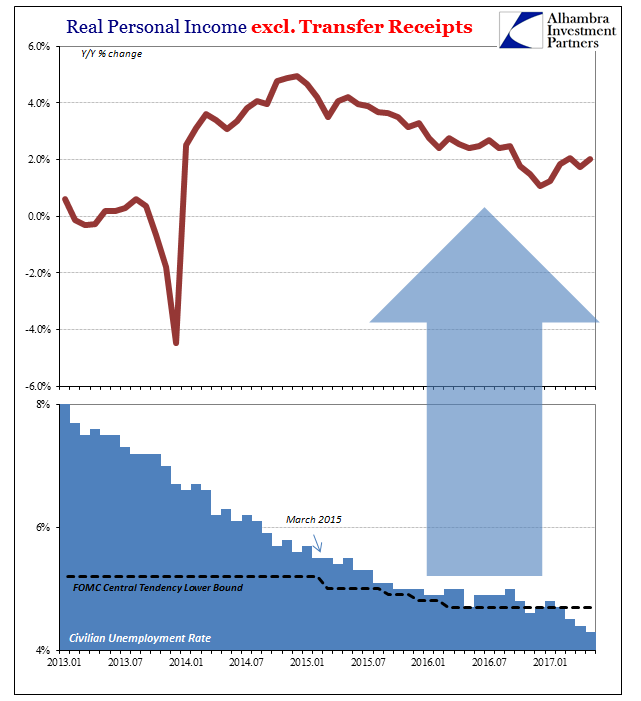

As of the latest BLS figures, the unemployment rate of 4.3% is significantly below the level at which the Fed’s models are sure inflation will be rising due to wage pressures. It isn’t, as incomes and wages remain in the same state as throughout the past few disappointing years. To acknowledge that “something” isn’t right, the staff at the US central bank has continued to mark down their projections for what constitutes “full employment.” At the last FOMC meeting, one at which the committee voted for another “rate hike”, the lower bound central tendency for “full employment” was reduced to 4.5% from 4.7%.

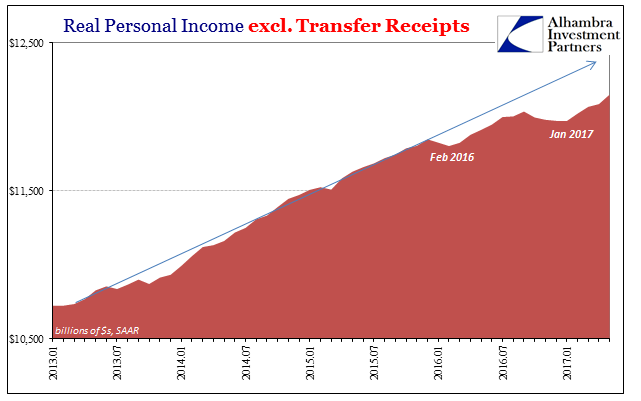

There continues to be a distinct lack of evidence that the unemployment is a relevant economic reflection. Broad income measurements remain weighted lower, as there aren’t any signs wages and therefore incomes are accelerating as they would clearly be if the true unemployment rate was so far below the central tendency.

As incomes remain stagnant, so does spending in both nominal as well as real terms. The consumer side of the economy is stuck in an almost recessionary level of “growth.” It does nothing to make up for the Great “Recession” while at the same time underperforming all prior “expansions.”

Leave A Comment