An erratic response which saw rapid gains followed by a return to earlier selling left markets struggling for traction. A move to retest lows looks favored, but selling volume was lighter which suggests bears may be running out of steam.

The S&P had climbed out of oversold levels, which means there is a room to return to such conditions. The S&P hasn’t yet done enough to generate a higher low.

The Nasdaq retains its out-performance relative to the S&P, and looks to be coiling towards a significant reaction. A move out of Friday’s narrow intraday range can be watched for leads. Momentum has shifted from a neutral to a more bearish outlook, leaving plenty of room for stochastics to fall back to oversold levels. Will bears get their wish?

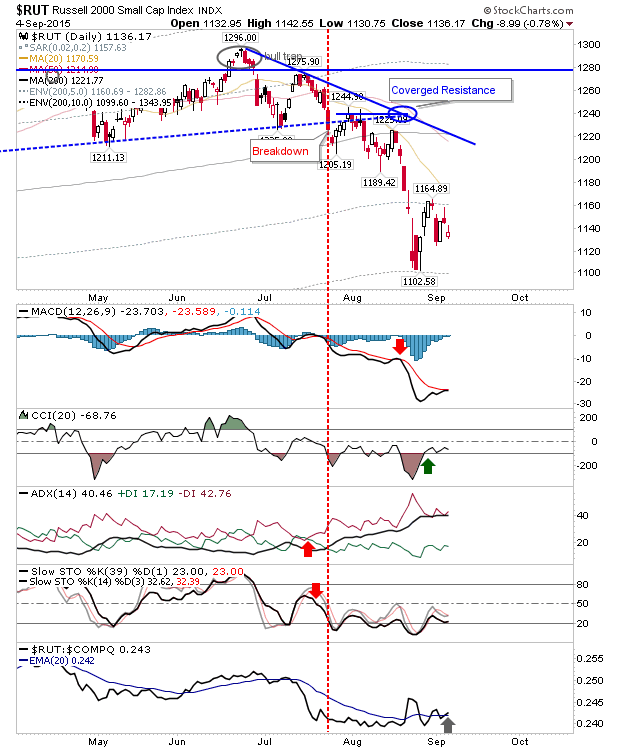

The Russell 2000 is the lead index of the bunch, but the last two days has seen selling into the close and Monday could be when this matures into more pronounced downside.

The silver lining for Tech indices may be the Semiconductor Index. The index is outperforming the Nasdaq 100, but it also looks like it wants to retest August lows.

The outlook for Monday looks bearish, but if bulls are able to press in premarket it will make shorts sweat their positions. A spread trade may offer the best reward.

Leave A Comment