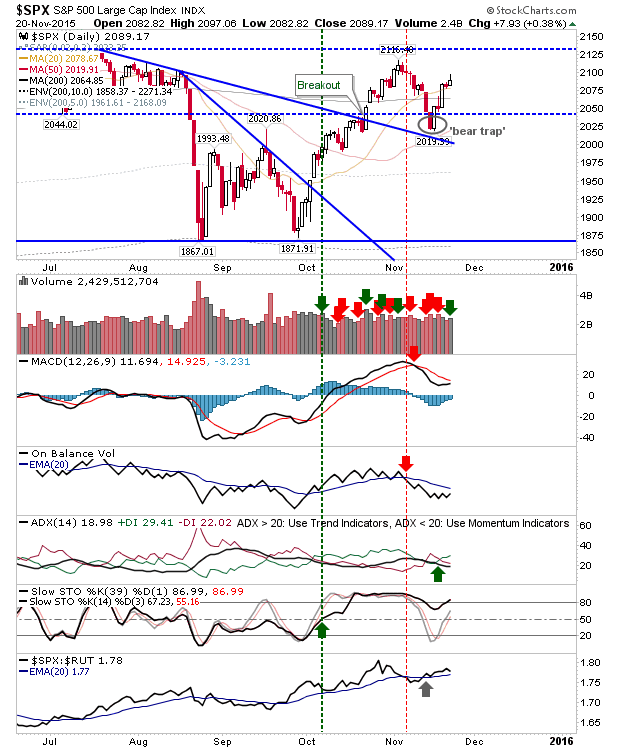

Friday was a low key affair. Small gains managed to rank as accumulation for the S&P, Dow Jones and Nasdaq 100, but there could be an argument for profit taking too.

The S&P remains above 20-day and 200-day MAs. Friday did finish with a small spike high but there is demand to quickly pull up on any weakness which may be delivered on Monday.

The Russell 2000 did manage a gain, but because of its relative underperformance and its position below its 200-day MA, bulls will need to do more if money is to rotate back to Small Caps. It’s the only real weakness of the October rally that Small Caps haven’t participated to the same degree as Large Caps or Tech indices.

Shorts may again go looking to the Nasdaq 100. Friday saw a doji just below resistance. However, the index has been here before and has punished shorts. Friday’s accumulation reversed the ‘sell’ trigger in On-Balance-Volume and the MACD is working towards a strong ‘buy’ signal. While bears might have the easier play on Monday, things are well set for a powerful bullish breakout – likely fueled by shorts scrambling.

The Semiconductor Index should be used as a guide for the Nasdaq and Nasdaq 100, This index continued to trade below its 200-day MA, and finished with an indecisive doji. A confident push above the nearby 200-day MA may be the cue to bring the breakout in the Nasdaq 100.

As we approach the end of November, the VXN is on course to finish with a doji and set up for a more volatile December. This would run contrary to the seasonal bullish set up for a ‘Santa Rally’. The month isn’t over yet, but this is something to watch.

For Monday, shorts may try (yet again) for the Nasdaq 100, but they may want to wait for the Semiconductor index to weaken before attacking. Bulls can watch the same Nasdaq 100, particularly if it gets above Friday’s high.

Leave A Comment