Molson Coors Brewing Company (TAP – Free Report) reported fourth-quarter 2017 results, wherein both the top and bottom line improved year over year and the latter also beat the Zacks Consensus Estimate. Further, the company exceeded its cost-savings target for the year, encouraging management to raise its three-year target for 2019.

The solid results helped this Zacks Rank #3 (Hold) stock gain 2.7% in the pre-market trading hours. Let’s see if this can bring a turn around to the stock’s otherwise drab performance. Well, Molson Coors’ shares have plunged 22.5% in a year, as against the industry’s growth of 14%.

Molson Coors’ adjusted earnings of 62 cents per share surged 31.9% year over year and surpassed the Zacks Consensus Estimate of 56 cents. The upside is attributable to favorable global pricing, net pension benefits, MG&A efficiencies and indirect tax provision cycling. However, this was partly countered by reduced volumes, inflation, greater underlying tax rate and investments in global business capacities.

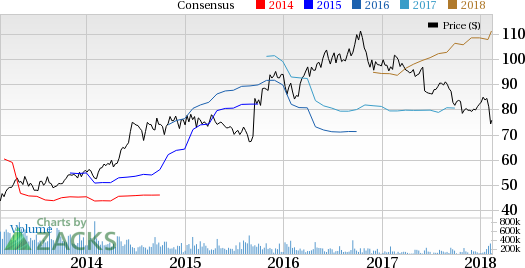

Molson Coors Brewing Company Price, Consensus and EPS Surprise

Molson Coors Brewing Company Price, Consensus and EPS Surprise | Molson Coors Brewing Company Quote

Delving Deeper

Net sales (excluding excise taxes) advanced 4.5% to $2,579.6 million but was below the Zacks Consensus Estimate of $2,597 million. The sales growth was backed by better global pricing, royalty volume, cycling of indirect tax provision and currency translations, somewhat negated by soft financial volumes. On a constant currency basis, net sales climbed 2.4%. While sales declined in the United States, it witnessed improvements in all other regions. Notably, net sales per hectoliter improved 5.8% (up 3.7% on a constant-currency basis), on the back of the same factors that drove net sales.

Molson Coors’ worldwide brand volume inched lower by 1.1% to 22.4 million hectoliters owing to soft U.S. and International volumes, partly compensated by strength in European and Canadian regions. Global priority volumes dipped 1.9%, while financial volumes slipped 1.2% to 23.1 million hectoliters. Financial volumes were hurt by softness in United States.

Leave A Comment