The US stock market this year has taken investors on a white-knuckled ride, but the momentum factor’s performance leadership has remained a constant in the US equity factor space, based on a set of proxy ETFs.

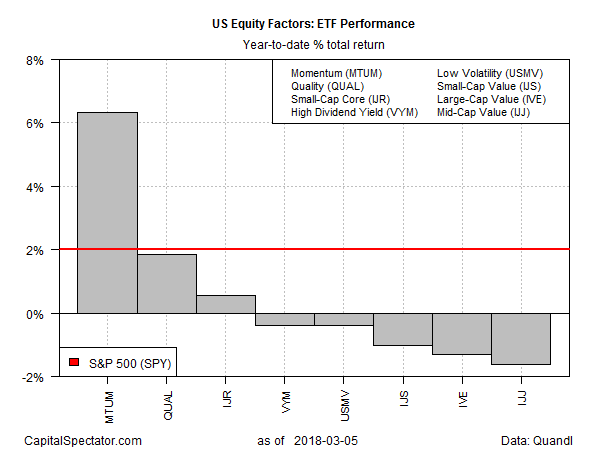

For year-to-date performance through yesterday’s close (Mar. 5), the iShares Edge MSCI USA Momentum Factor (MTUM) remains the clear leader. Indeed, MTUM’s 6.3% return so far this year is well above the rest of the field, which reflects a mixed set of modest gains and losses.

MTUM’s year-to-date edge is also decisive vs. the broad equity market. The SPDR S&P 500 (SPY) is up a respectable 2.0% this year through Monday, but that’s no match for MTUM’s year-to-date performance.

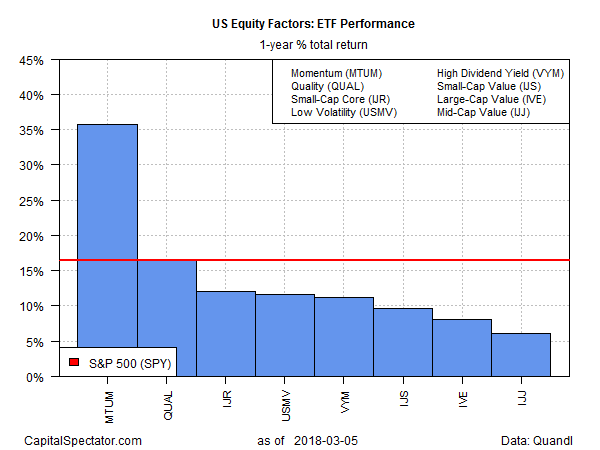

MTUM remains the dominant performer for the one-year change too. The iShares Edge MSCI USA Momentum Factor ETF is currently posting a sizzling 35.7% total return. The next-strongest one-year return is a distant 16.5% gain for iShares Edge MSCI USA Quality Factor ETF (QUAL), which is fractionally ahead of the broad market’s 16.4% one-year advance based on SPY.

Momentum’s edge can’t last forever, but at the moment there’s no sign that MTUM’s strong run in relative and absolute terms is faltering. Weakness in the broad equity market could derail momentum’s leadership in the factor space, but yesterday’s rally in the S&P 500 suggests that the crowd’s bullish sentiment still has room to run.

Even a relatively sharp pullback in MTUM would leave the ETF far ahead of its factor competitors. As the performance chart below reminds, MTUM’s rally over the past year (black line at top) has been extraordinarily powerful compared with other factor ETFs.

Leave A Comment